Page 495 - AR DPBM-2016--SMALL

P. 495

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

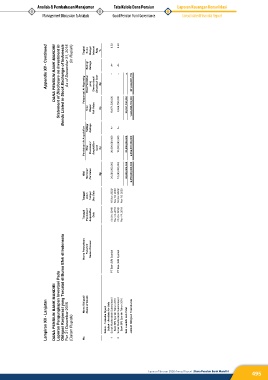

Appendix XII - Continued DANA PENSIUN BANK MANDIRI Statement of Disclosure on Investment In Bonds Listed in Stock Exchange of Indonesia As of December 31, 2016 (In Rupiah) Tingkat Pelaporan/ At Reporting Suku Rating/ Nilai Perolehan Bunga/ Bunga/ Ratings yang Interest Diamortisasi/ Rate Amortized Cost % Rp 9.50 A+ -- 9.50 A+ -- -- 811,042,881,733

Perolehan/ At Acquisition Nilai Rating/ Nilai Wajar/ Ratings Perolehan/ Fair Value Acquisition Cost Rp Rp 19,971,500,000 A+ 20,000,000,000 9,985,750,000 A+ 10,000,000,000 29,957,250,000 30,000,000,000 1,246,825,763,300 2,062,876,300,000

Nilai Nominal/ Par Value Rp 20,000,000,000 10,000,000,000 30,000,000,000 2,059,600,000,000

Tanggal Jatuh Tempo/ Due Date 16 Nov 2023/ Nov 16, 2023 16 Nov 2023/ Nov 16, 2023

Tanggal Perolehan/ AcquisitIon Date 14 Nov 2016/ Nov 14, 2016 14 Nov 2016/ Nov 14, 2016

Nama Perusahaan Penerbit/ Name of Issuer PT Bank BRI Syariah PT Bank BRI Syariah

Lampiran XII - Lanjutan DANA PENSIUN BANK MANDIRI Laporan Pengungkapan Investasi Pada Obligasi Korporasi yang Tercatat di Bursa Efek di Indonesia Per 31 Desember 2016 (Dalam Rupiah) Nama Obligasi/ Name of Bonds Sukuk - Tersedia Dijual/ Sukuk - Availabe for Sale Sukuk Mudharabah Subordinasi I Bank BRI Syariah Tahun 2016 Sukuk Mudharabah Subordinasi I Bank BRI Syariah Tahun 2016 Sub Jumlah/ Sub Total Jumlah Obligasi/ Total Bonds

No. 1 2

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

495