Page 498 - AR DPBM-2016--SMALL

P. 498

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

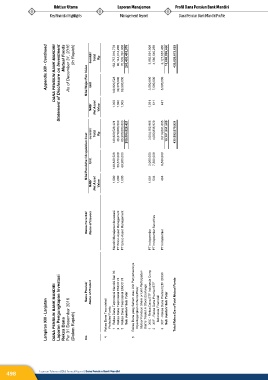

Appendix XIII - Continued DANA PENSIUN BANK MANDIRI Statement of Disclosure on Investment Mutual Funds As of December 31, 2016 (In Rupiah) Nilai Wajar/Fair Value Jumlah/ Unit NAB/ Total Net Asset Rp Value 152,757,010,778 149,820,528 1,020 40,144,014,200 39,370,000 1,020 70,535,391,000 69,900,000 1,009 263,436,415,978 3,092,691,000 3,000,000 1,031 4,580,540,250 7,500,000 611 3,127,667,400 6,500,000 481 10,800,898,

Nilai Perolehan/Acquisition Cost Jumlah/ Unit Total Rp 149,820,528,421 149,820,528 39,370,000,000 39,370,000 69,900,000,000 69,900,000 259,090,528,421 3,004,152,966 3,000,000 4,082,836,929 7,500,000 3,014,561,605 6,500,000 10,101,551,500 435,992,079,921

NAB/ Net Asset Value 1,000 1,000 1,000 1,001 544 464

Nama Penerbit/ Name of Issuers Mandiri Manajemen Investasi PT Emco Asset Management PT Emco Asset Management PT Indopremier PT Indopremier Securities PT Indopremier

Lampiran XIII - Lanjutan DANA PENSIUN BANK MANDIRI Laporan Pengungkapan Investasi Reksa Dana Per 31 Desember 2016 (Dalam Rupiah) Nama Produk/ Name of Product Reksa Dana Terproteksi/ Protected Funds Reksa Dana Terproteksi Mandiri Seri 36 1 Reksa Dana Terproteksi EMCO VI 2 Reksa Dana Terproteksi EMCO VI 3 Sub Jumlah/ Sub Total Reksa Dana yang Saham atau Unit Penyertaannya Diperdagangkan di Bursa Efek/ Mutual Fundson Share or Unit Part

No. 4 5

498 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri