Page 82 - QEB_2_2016_lowres

P. 82

The IMF expects the UK economy to shrink by between 1.4%–4.3%. The upper limit

appears to be very pessimistic though. In response to economic decline and liquidity

risk, the BoE has made 250 billion GBP available. It is likely that the Conservative’s goal

to reduce government debt will be delayed to limit the effect of Brexit.

Emerging Market and Developing Economies

Growth in developing economies continue to outpace that of developed economies.

It is projected to increase from 4% in 2015 to 4.6% in 2017. Growth in emerging Europe is

projected to continue at a steady pace in 2016, with Russia remaining in recession.

In Latin America and the Caribbean, a number of economies are projected to contract

in 2016, with Brazil remaining in recession and confidence taking a heavy knock given

the corruption developments (Petrobras Saga) and impeachment of the president by

parliament.

Whilst higher growth is projected for the Middle East, there are concerns about lower

oil prices and in some cases geopolitical tensions, which have the capacity to weigh

negatively on the outlook.

BRICS

China and India are both projected to continue having robust growth rates of above

5%. The slowing down and rebalancing of the Chinese economy (from investment and

manufacturing to consumption and services) had spillover effects on a number of

emerging markets trading with China.

Economic data released for the first quarter of 2016 by the Chinese National Bureau of

Statistics show:

• evidence of stabilisation with a growth rate of 6.7%;

• a rise in fixed-asset investment of 10.7%; and

• an expansion of industrial output by 5.8%.

India’s robust growth continues to surprise. While many economists are questioning

India’s actual growth, the global BPO and ICT Services hub’s growth rate is expected to

be around 7%, supported by domestic growth.

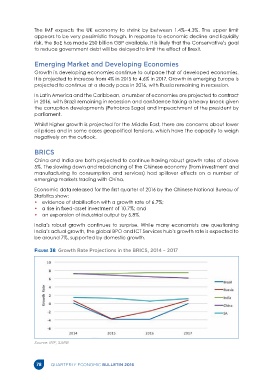

Figure 38 Growth Rate Projections in the BRICS, 2014 – 2017

Source: IMF, SARB

78 QUARTERLY ECONOMIC BULLETIN 2016