Page 6 - McLarty 2017-2018 Benefits Booklet_Finished

P. 6

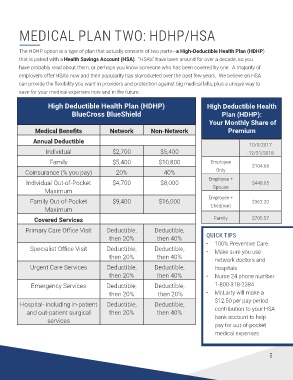

MEDICAL PLAN TWO: HDHP/HSA

The HDHP option is a type of plan that actually consists of two parts—a High-Deductible Health Plan (HDHP)

that is paired with a Health Savings Account (HSA). “HSA’s” have been around for over a decade, so you

have probably read about them, or perhaps you know someone who has been covered by one. A majority of

employers offer HSA’s now and their popularity has skyrocketed over the past few years. We believe an HSA

can provide the flexibility you want in providers and protection against big medical bills, plus a unique way to

save for your medical expenses now and in the future.

High Deductible Health Plan (HDHP) High Deductible Health

BlueCross BlueShield Plan (HDHP):

Your Monthly Share of

Medical Benefits Network Non-Network Premium

Annual Deductible

10/1/2017

Individual $2,700 $5,400 -12/31/2018

Family $5,400 $10,800 Employee $104.68

Coinsurance (% you pay) 20% 40% Only

Employee +

Individual Out-of-Pocket $4,700 $8,000 $448.05

Maximum Spouse

Employee +

Family Out-of-Pocket $9,400 $16,000 $362.20

Maximum Child(ren)

Covered Services Family $705.57

Primary Care Office Visit Deductible, Deductible,

then 20% then 40% QUICK TIPS

• 100% Preventive Care

Specialist Office Visit Deductible, Deductible, • Make sure you use

then 20% then 40% network doctors and

Urgent Care Services Deductible, Deductible, hospitals

then 20% then 40% • Nurse 24 phone number:

Emergency Services Deductible, Deductible, 1-800-318-2384

then 20% then 20% • McLarty will make a

$12.50 per pay-period

Hospital- including in-patient Deductible, Deductible,

and out-patient surgical then 20% then 40% contribution to your HSA

services bank account to help

pay for out-of-pocket

medical expenses

5