Page 9 - McLarty 2017-2018 Benefits Booklet_Finished

P. 9

HEALTH SAVINGS BANK ACCOUNT(NOTE: PAIRED WITH HDHP ONLY)

Health Savings Accounts (HSAs) are tax advantaged bank

TO BE ELIGIBLE FOR AN HSA,

THE FOLLOWING MUST BE TRUE. accounts. If you enroll in McLarty’s HDHP/HSA medical

plan, you will be eligible to open an HSA bank account. The

1. You must have coverage under contributions you make to HSAs are not subject to federal

a qualified plan such as McLarty income, social security, Medicare, and most state income

Automotive Group’s HDHP tax. The earnings on the account are tax free. In addition,

2. You cannot have coverage under withdrawals can be made from HSAs on a tax-free basis as

a non-qualified plan, including long as they are used for qualified health expenses. If you

traditional, non-HDHP family enroll in the HSA plan and meet all eligibility requirements

coverage through your spouse set by the IRS, you may contribute to an HSA account.

or a traditional health flexible

Note: employees who sign up for the HDHP must take action and open up a health

spending account (either through

savings account.

McLarty Automotive Group or

through your spouse’s employer). Contributing to Your HSA

For example, you cannot open When you enroll in the HDHP and you open a health savings

and contribute money to an HSA account, you can make pre-tax contributions to your HSA

if you are contributing money through payroll deductions or you can deposit on your own into

to the traditional health flexible your HSA bank account. It’s your choice to contribute or not.

spending account (FSA). The IRS limits the amount of pre-tax dollars you can contribute

3. You cannot be claimed as a to your HSA each year. If you enroll mid-year, you still can

dependent on another person’s contribute the total allowable amount for that year; however, to

tax return take advantage of the tax savings, you must:

4. You cannot be enrolled in • Stay enrolled in a qualifying high-deductible health plan for

Medicare, Medicaid or Tricare the following 12 months.

5. You cannot have received VA • Not have other health care coverage that would make you

Medical benefits within the last ineligible to contribute to an HSA.

three months

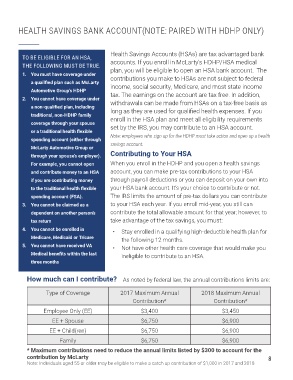

How much can I contribute? As noted by federal law, the annual contributions limits are:

Type of Coverage 2017 Maximum Annual 2018 Maximum Annual

Contribution* Contribution*

Employee Only (EE) $3,400 $3,450

EE + Spouse $6,750 $6,900

EE + Child(ren) $6,750 $6,900

Family $6,750 $6,900

* Maximum contributions need to reduce the annual limits listed by $300 to account for the

contribution by McLarty 8

Note: Individuals aged 55 or older may be eligible to make a catch up contribution of $1,000 in 2017 and 2018