Page 19 - McLarty 2017-2018 Benefits Booklet

P. 19

ADDITIONAL VOLUNTARY PLANS FROM GUARDIAN

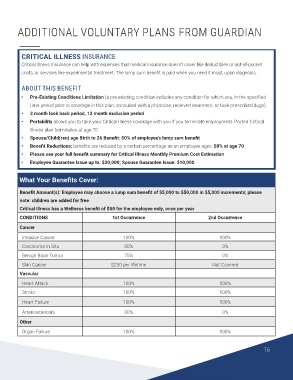

CRITICAL ILLNESS INSURANCE

Critical Illness Insurance can help with expenses that medical insurance doesn’t cover like deductibles or out-of-pocket

costs, or services like experimental treatment. The lump sum benefit is paid when you need it most, upon diagnosis.

ABOUT THIS BENEFIT

• Pre-Existing Conditions Limitation (a pre-existing condition includes any condition for which you, in the specified

time period prior to coverage in this plan, consulted with a physician, received treatment, or took prescribed dugs).

• 3 month look back period, 12 month exclusion period

• Portability allows you to take your Critical Illness coverage with you if you terminate employment. Ported Critical

Illness plan terminates at age 70

• Spouse/Child(ren) age Birth to 26 Benefit: 50% of employee’s lump sum benefit

• Benefit Reductions: benefits are reduced by a certain percentage as an employee ages: 50% at age 70

• Please see your full benefit summary for Critical Illness Monthly Premium Cost Estimation

• Employee Guarantee Issue up to: $30,000; Spouse Guarantee Issue: $10,000

What Your Benefits Cover:

Benefit Amount(s): Employee may choose a lump sum benefit of $5,000 to $50,000 in $5,000 increments; please

note: children are added for free

Critical Illness has a Wellness benefit of $50 for the employee only, once per year

CONDITIONS 1st Occurrence 2nd Occurrence

Cancer

Invasive Cancer 100% 100%

Carcinoma In Situ 30% 0%

Benign Brain Tumor 75% 0%

Skin Cancer $250 per lifetime Not Covered

Vascular

Heart Attack 100% 100%

Stroke 100% 100%

Heart Failure 100% 100%

Arteriosclerosis 30% 0%

Other

Organ Failure 100% 100%

16