Page 4 - Suri’s - NCDRC ON LIFE INSURANCE 2017 V1.3

P. 4

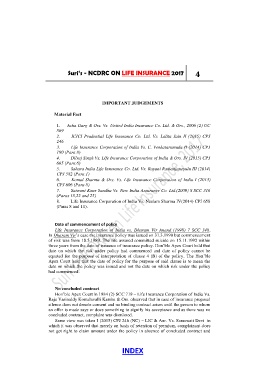

Suri’s - NCDRC ON LIFE INSURANCE 2017 4

IMPORTANT JUDGEMENTS

Material Fact

1. Asha Garg & Ors. Vs. United India Insurance Co. Ltd. & Ors., 2006 (2) UC

869

2. ICICI Prudential Life Insurance Co. Ltd. Vs. Lalita Jain II (2015) CPJ

246

3. Life Insurance Corporation of India Vs. C. Venkataramudu II (2014) CPJ

190 (Para 8)

4. Dilraj Singh Vs. Life Insurance Corporation of India & Ors. IV (2015) CPJ

665 (Para 6)

5. Sahara India Life Insurance Co. Ltd. Vs. Rayani Ramanjaneyulu III (2014)

CPJ 582 (Para 1)

6. Komal Sharma & Ors. Vs. Life Insurance Corporation of India I (2013)

CPJ 606 (Para 8)

7. Satwant Kaur Sandhu Vs. New India Assurance Co. Ltd.(2009) 8 SCC 316

(Paras 18,22 and 25)

8. Life Insurance Corporation of India Vs. Neelam Sharma IV(2014) CPJ 658

(Paras 8 and 11).

Date of commencement of policy

Life Insurance Corporation of India vs. Dharam Vir Anand (1998) 7 SCC 348.

In Dharam Vir‘s case the insurance policy was issued on 31.3.1990 but commencement

of risk was from 10.5.1989. The life assured committed suicide on 15.11.1992 within

three years from the date of issuance of insurance policy. Hon‘ble Apex Court held that

date on which the risk under policy had commenced and date of policy cannot be

equated for the purpose of interpretation of clause 4 (B) of the policy. The Hon‘ble

Apex Court held that the date of policy for the purpose of said clause is to mean the

date on which the policy was issued and not the date on which risk under the policy

had commenced.

No concluded contract

Hon‘ble Apex Court in 1984 (2) SCC 719 – Life Insurance Corporation of India Vs.

Raja Vasireddy Komalavalli Kamba & Ors. observed that in case of insurance proposal

silence does not denote consent and no binding contract arises until the person to whom

an offer is made says or does something to signify his acceptance and as there was no

concluded contract, complaint was dismissed.

Same view was taken I (2015) CPJ 246 (NC) – LIC & Anr. Vs. Saraswati Devi in

which it was observed that merely on basis of retention of premium, complainant does

not get right to claim amount under the policy in absence of concluded contract and

INDEX