Page 7 - Suri’s - NCDRC ON LIFE INSURANCE 2017 V1.3

P. 7

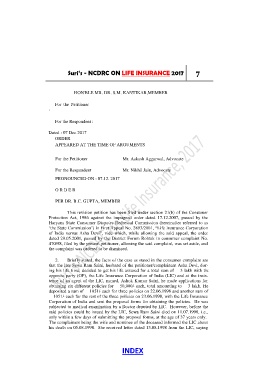

Suri’s - NCDRC ON LIFE INSURANCE 2017 7

HON'BLE MR. DR. S.M. KANTIKAR,MEMBER

For the Petitioner

:

For the Respondent :

Dated : 07 Dec 2017

ORDER

APPEARED AT THE TIME OF ARGUMENTS

:

For the Petitioner Mr. Aakash Aggarwal, Advocate

:

For the Respondent Mr. Nikhil Jain, Advocate

PRONOUNCED ON : 07.12. 2017

O R D E R

PER DR. B.C. GUPTA, MEMBER

This revision petition has been filed under section 21(b) of the Consumer

Protection Act, 1986 against the impugned order dated 17.12.2007, passed by the

Haryana State Consumer Disputes Redressal Commission (hereinafter referred to as

‗the State Commission‘) in First Appeal No. 2893/2001, ―Life Insurance Corporation

of India versus Asha Devi‖, vide which, while allowing the said appeal, the order

dated 29.05.2001, passed by the District Forum Rohtak in consumer complaint No.

470/98, filed by the present petitioner, allowing the said complaint, was set aside, and

the complaint was ordered to be dismissed.

2. Briefly stated, the facts of the case as stated in the consumer complaint are

that the late Sewa Ram Saini, husband of the petitioner/complainant Asha Devi, dur-

ing his life time, decided to get his life assured for a total sum of ₹3 lakh with the

opposite party (OP), the Life Insurance Corporation of India (LIC) and at the insis-

tence of an agent of the LIC, named, Ashok Kumar Saini, he made applications for

obtaining six different policies for ₹50,000/- each, total amounting to ₹3 lakh. He

deposited a sum of ₹1051/- each for three policies on 22.06.1998 and another sum of

₹1051/- each for the rest of the three policies on 23.06.1998, with the Life Insurance

Corporation of India and sent the proposal forms for obtaining the policies. He was

subjected to medical examination by a Doctor deputed by LIC. However, before the

said policies could be issued by the LIC, Sewa Ram Saini died on 11.07.1998, i.e.,

only within a few days of submitting the proposal forms, at the age of 37 years only.

The complainant being the wife and nominee of the deceased informed the LIC about

his death on 05.08.1998. She received letter dated 13.08.1998 from the LIC, saying

INDEX