Page 8 - drive a2b july 2020 web

P. 8

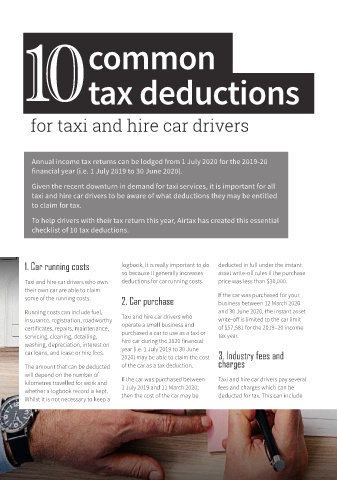

10 common

tax deductions

for taxi and hire car drivers

Annual income tax returns can be lodged from 1 July 2020 for the 2019-20

financial year (i.e. 1 July 2019 to 30 June 2020).

Given the recent downturn in demand for taxi services, it is important for all

taxi and hire car drivers to be aware of what deductions they may be entitled

to claim for tax.

To help drivers with their tax return this year, Airtax has created this essential

checklist of 10 tax deductions.

1. Car running costs logbook, it is really important to do deducted in full under the instant

so because it generally increases asset write-off rules if the purchase

Taxi and hire car drivers who own deductions for car running costs. price was less than $30,000.

their own car are able to claim

some of the running costs. 2. Car purchase If the car was purchased for your

business between 12 March 2020

Running costs can include fuel, and 30 June 2020, the instant asset

insurance, registration, roadworthy Taxi and hire car drivers who write-off is limited to the car limit

certificates, repairs, maintenance, operate a small business and of $57,581 for the 2019–20 income

servicing, cleaning, detailing, purchased a car to use as a taxi or tax year.

washing, depreciation, interest on hire car during the 2020 financial

car loans, and lease or hire fees. year (i.e. 1 July 2019 to 30 June

2020) may be able to claim the cost 3. Industry fees and

The amount that can be deducted of the car as a tax deduction. charges

will depend on the number of If the car was purchased between Taxi and hire car drivers pay several

kilometres travelled for work and 1 July 2019 and 11 March 2020, fees and charges which can be

whether a logbook record is kept. then the cost of the car may be deducted for tax. This can include

Whilst it is not necessary to keep a

8 DRIVE A2B magazine · www.drivea2b.com.au · July 2020