Page 106 - Corporate Finance PDF Final new link

P. 106

NPP

106 Corporate Finance BRILLIANT’S

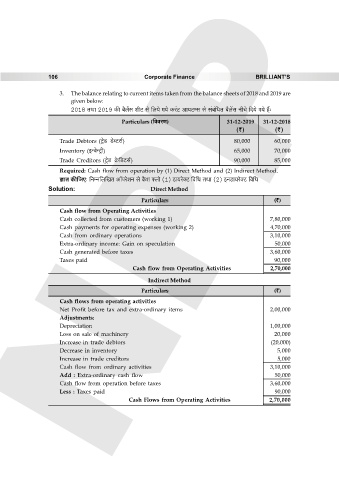

3. The balance relating to current items taken from the balance sheets of 2018 and 2019 are

given below:

2018 VWm 2019 H$s ~¡b|g erQ> go {b`o J`o H$a§Q> Am`Q>åg go g§~§{YV ~¡b|g ZrMo {X`o J`o h¢…

Particulars ({ddaU) 31-12-2019 31-12-2018

(`) (`)

Trade Debtors (Q´>oS> S>oãQ>g©) 80,000 60,000

Inventory (BÝdoÝQ´>r) 65,000 70,000

Trade Creditors (Q´>oS> H«o${S>Q>g©) 90,000 85,000

Required: Cash flow from operation by (1) Direct Method and (2) Indirect Method.

kmV H$s{OE… {ZåZ{b{IV Am°naoeZ go H¡$e âbmo (1) S>m`aoŠQ> {d{Y VWm (2) BZS>m`aoŠQ> {d{Y

Solution: Direct Method

Particulars (`)

Cash flow from Operating Activities

Cash collected from customers (working 1) 7,80,000

Cash payments for operating expenses (working 2) 4,70,000

Cash from ordinary operations 3,10,000

Extra-ordinary income: Gain on speculation 50,000

Cash generated before taxes 3,60,000

Taxes paid 90,000

Cash flow from Operating Activities 2,70,000

Indirect Method

Particulars (`)

Cash flows from operating activities

Net Profit before tax and extra-ordinary items 2,00,000

Adjustments:

Depreciation 1,00,000

Loss on sale of machinery 20,000

Increase in trade debtors (20,000)

Decrease in inventory 5,000

Increase in trade creditors 5,000

Cash flow from ordinary activities 3,10,000

Add : Extra-ordinary cash flow 50,000

Cash flow from operation before taxes 3,60,000

Less : Taxes paid 90,000

Cash Flows from Operating Activities 2,70,000