Page 194 - Corporate Finance PDF Final new link

P. 194

NPP

194 Corporate Finance BRILLIANT’S

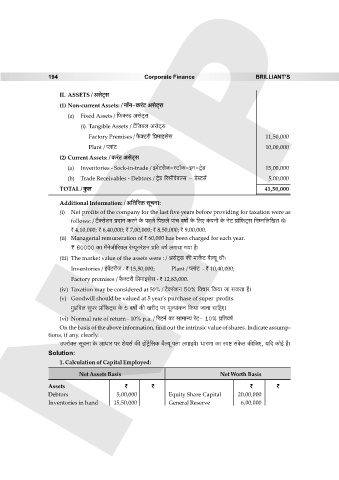

II. ASSETS / AgoQ²>g

(1) Non-current Assets: / Zm°Z-H$a§Q> AgoQ²>g

(a) Fixed Assets / {’$³ñS> AgoQ²>g

(i) Tangible Assets / Q>¢{O~b AgoQ²>g

Factory Premises / ’¡$³Q>ar {à‘mBgog 11,50,000

Plant / ßbm§Q> 10,00,000

(2) Current Assets: / H$a§Q> AgoQ²>g

(a) Inventories - Sock-in-trade / B§d|Q>arO-ñQ>m°H$-BZ-Q´>oS> 15,00,000

(b) Trade Receivables - Debtors / Q´>oS> [agrdo~ëg - S>oãQ>g© 5,00,000

TOTAL / Hw$b 41,50,000

Additional Information: / A{V[aº$ gyMZm:

(i) Net profits of the company for the last five years before providing for taxation were as

follows: / Q>¡³goeZ àXmZ H$aZo Ho$ nhbo {nN>bo nm§M dfm] Ho$ {bE H§$nZr Ho$ ZoQ> àm°{’$Q²>g {ZåZ{b{IV Wo…

` 4,10,000; ` 6,40,000; ` 7,00,000; ` 8,50,000; ` 9,00,000.

(ii) Managerial remuneration of ` 60,000 has been charged for each year.

< 60000 H$m ‘¡ZoOr[a¶b aoå¶yZaoeZ à{V df© bJm¶m J¶m h¡&

(iii) The market value of the assets were : / AgoQ²>g H$s ‘mH}$Q> d¡ë¶y Wr…

Inventories / B§d|Q>arO - ` 15,50,000; Plant / ßbm§Q> - ` 10,40,000;

Factory premises / ’¡$³Q>ar {à‘mBgog - ` 12,83,000.

(iv) Taxation may be considered at 50% / Q>¡³goeZ 50% {dMma {H$¶m Om gH$Vm h¡&

(v) Goodwill should be valued at 5 year's purchase of super profits.

JwS>{db gwna àm°{’$Q²>g Ho$ 5 dfm] H$s IarX na ‘yë¶m§H$Z {H$¶m OmZm Mm{hE&

(vi) Normal rate of return - 10% p.a. / [aQ>Z© H$m gm‘mݶ aoQ>- 10% à{Vdf©

On the basis of the above information, find out the intrinsic value of shares. Indicate assump-

tions, if any, clearly.

Cnamo³V gyMZm Ho$ AmYma na eo¶g© H$s B§qQ´>{gH$ d¡ë¶y nVm bJmB¶o& YmaUm H$m ñnï> g§Ho$V H$s{OE, ¶{X H$moB© h¡&

Solution:

1. Calculation of Capital Employed:

Net Assets Basis Net Worth Basis

Assets ` ` ` `

Debtors 5,00,000 Equity Share Capital 20,00,000

Inventories in hand 15,50,000 General Reserve 6,00,000