Page 196 - Corporate Finance PDF Final new link

P. 196

NPP

196 Corporate Finance BRILLIANT’S

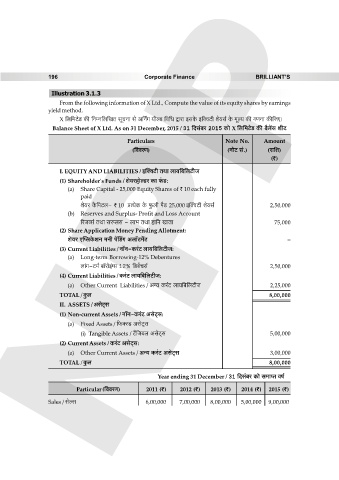

Illustration 3.1.3

From the following information of X Ltd., Compute the value of its equity shares by earnings

yield method.

X {b{‘Q>oS> H$s {ZåZ{b{IV gyMZm go A{ZªJ ¶rëS> {d{Y Ûmam BgHo$ B{³dQ>r eo¶g© Ho$ ‘yë¶ H$s JUZm H$s{OE&

Balance Sheet of X Ltd. As on 31 December, 2015 / 31 {Xg§~a 2015 H$mo X {b{‘Q>oS> H$s ~¡b|g erQ>

Particulars Note No. Amount

({ddaU) (ZmoQ> g§.) (am{e)

(`)

I. EQUITY AND LIABILITIES / Bp³dQ>r VWm bm¶{~{bQ>rO

(1) Shareholder's Funds / eo¶ahmoëS>a H$m ’§$S>:

(a) Share Capital - 25,000 Equity Shares of ` 10 each fully

paid

eo¶a H¡${nQ>b- ` 10 à˶oH$ Ho$ ’w$br n¡S> 25,000 Bp³dQ>r eo¶g© 2,50,000

(b) Reserves and Surplus- Profit and Loss Account

[aOìg© VWm gaßbg - bm^ VWm hm{Z ImVm 75,000

(2) Share Application Money Pending Allotment:

eo¶a EpßbHo$eZ ‘Zr n|qS>J Abm°Q>‘|Q> –

(3) Current Liabilities / Zm°Z-H$a§Q> bm¶{~{bQ>rO:

(a) Long-term Borrowing-12% Debentures

bm§J-Q>‘© ~m°amoB§½g 12% {S>~|Mg© 2,50,000

(4) Current Liabilities / H$a§Q> bm¶{~{bQ>rO:

(a) Other Current Liabilities / Aݶ H$a§Q> bm¶{~{bQ>rO 2,25,000

TOTAL / Hw$b 8,00,000

II. ASSETS / AgoQ²>g

(1) Non-current Assets / Zm°Z-H$a§Q> AgoQ²>g:

(a) Fixed Assets / {’$³ñS> AgoQ²>g

(i) Tangible Assets / Q>¢{O~b AgoQ²>g 5,00,000

(2) Current Assets / H$a§Q> AgoQ²>g:

(a) Other Current Assets / Aݶ H$a§Q> AgoQ²>g 3,00,000

TOTAL / Hw$b 8,00,000

Year ending 31 December / 31 {Xg§~a H$mo g‘mßV df©

Particular ({ddaU) 2011 (`) 2012 (`) 2013 (`) 2014 (`) 2015 (`)

Sales / goëg 6,00,000 7,00,000 8,00,000 5,00,000 9,00,000