Page 202 - Corporate Finance PDF Final new link

P. 202

202 Corporate Finance BRILLIANT’S

2013-14: ` 51,600; 2014-15; ` 52,000; and 2015-16: ` 51,650 of which 20% was placed to re-

serve, this proportion being considered reasonable in the industry in which the company is

engaged and where a fair investment return may be taken at 10%.

Compute the value of the company's shares by (a) the assets backing method and (b) the

dividend yield method.

31 ‘mM© 2016 H$mo Q>|{O~b {’$³ñS> AgoQ²>g H$m ñdV§Ì ê$n go < 5,50,000 na VWm JwS>{db H$m < 50,000

na ‘yë¶m§H$Z {H$¶m J¶m Wm& VrZ dfm] Ho$ {bE Q>¡³g Ho$ níMmV² ZoQ> àm°{’$Q> Wo…

2013-14… < 51600; 2014-15… < 52,000 VWm 2015-16… < 51650 {OgH$m 20% [aOd© aIm

J¶m Wm, ¶h AZwnmV CÚmoJ ‘| C{MV {dMma {H$¶m OmVm h¡ {Og‘| H§$nZr {bßV h¡ VWm Ohm§ na EH$ C{MV B§doñQ>‘|Q> [aQ>Z©

10% na n«má {H$¶m Om gH$Vm h¡& (a) AgoQ²>g ~¢qH$J {d{Y VWm (b) {S>{dS>|S> ¶rëS> {d{Y Ûmam H§$nZr Ho$ eo¶a Ho$ ‘yë¶

H$s JUZm H$s{OE&

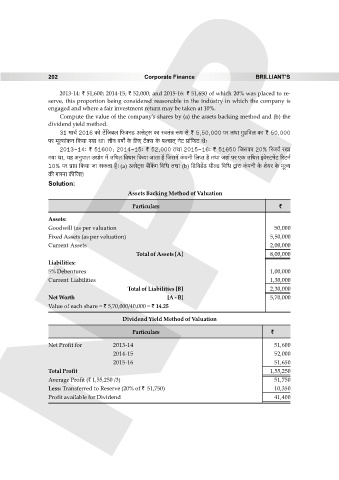

Solution:

Assets Backing Method of Valuation

Particulars `

Assets: NPP

Goodwill (as per valuation 50,000

Fixed Assets (as per valuation) 5,50,000

Current Assets 2,00,000

Total of Assets [A] 8,00,000

Liabilities:

5% Debentures 1,00,000

Current Liabilities 1,30,000

Total of Liabilities [B] 2,30,000

Net Worth [A - B] 5,70,000

Value of each share = ` 5,70,000/40,000 = ` 14.25

Dividend Yield Method of Valuation

Particulars `

Net Profit for 2013-14 51,600

2014-15 52,000

2015-16 51,650

Total Profit 1,55,250

Average Profit (` 1,55,250 /3) 51,750

Less: Transferred to Reserve (20% of ` 51,750) 10,350

Profit available for Dividend 41,400