Page 203 - Corporate Finance PDF Final new link

P. 203

NPP

BRILLIANT’S Long Term Financing and Valuation of Goodwill & Shares 203

` 41,400

Expected Rate of Dividend = 100 = 10.35 %

4,00,000

ExpectedRateof Dividend 10.35%

Value per Share Paid up Value ` 10 = ` 10.35

NormalRateofReturn 10%

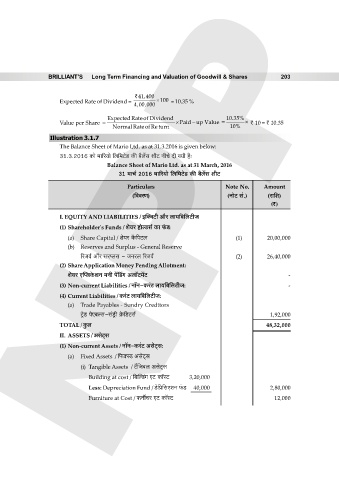

Illustration 3.1.7

The Balance Sheet of Mario Ltd. as at 31.3.2016 is given below:

31.3.2016 H$mo ‘m[a¶mo {b{‘Q>oS> H$s ~¡b|g erQ> ZrMo Xr J¶r h¡…

Balance Sheet of Mario Ltd. as at 31 March, 2016

31 ‘mM© 2016 ‘m[a¶mo {b{‘Q>oS> H$s ~¡b|g erQ>

Particulars Note No. Amount

({ddaU) (ZmoQ> g§.) (am{e)

(`)

I. EQUITY AND LIABILITIES / Bp³dQ>r Am¡a bm¶{~{bQ>rO

(1) Shareholder's Funds / eo¶a hmoëS>g© H$m ’§$S:

(a) Share Capital / eo¶a H¡${nQ>b (1) 20,00,000

(b) Reserves and Surplus - General Reserve

[aOd© Am¡a gaßbg - OZab [aOd© (2) 26,40,000

(2) Share Application Money Pending Allotment:

eo¶a EpßbHo$eZ ‘Zr n|qS>J Abm°Q>‘|Q> -

(3) Non-current Liabilities / Zm°Z-H$a§Q> bm¶{~{bQ>rO: -

(4) Current Liabilities / H$a§Q> bm¶{~{bQ>rO:

(a) Trade Payables - Sundry Creditors

Q´>oS> noE~ëg-g§S´>r H«o${S>Q>g© 1,92,000

TOTAL / Hw$b 48,32,000

II. ASSETS / AgoQ²>g

(1) Non-current Assets / Zm°Z-H$a§Q> AgoQ²>g:

(a) Fixed Assets / {’$³ñS> AgoQ²>g

(i) Tangible Assets / Q>¢{O~b AgoQ²>g

Building at cost / {~pëS>¨J EQ> H$m°ñQ> 3,20,000

Less: Depreciation Fund / S>o{à{gEeZ ’§$S> 40,000 2,80,000

Furniture at Cost / ’$ZuMa EQ> H$m°ñQ> 12,000