Page 10 - Reverse_Mortgage_Loan_Retirement_Planner

P. 10

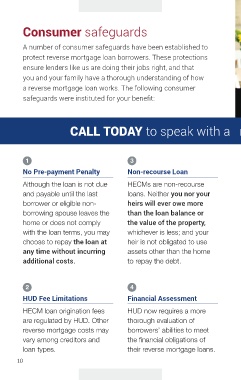

Consumer safeguards

A number of consumer safeguards have been established to

protect reverse mortgage loan borrowers. These protections

ensure lenders like us are doing their jobs right, and that

you and your family have a thorough understanding of how

a reverse mortgage loan works. The following consumer

safeguards were instituted for your benefit:

CALL TODAY to speak with a reverse mortgage professional.

1 3

No Pre-payment Penalty Non-recourse Loan

Although the loan is not due HECMs are non-recourse

and payable until the last loans. Neither you nor your

borrower or eligible non- heirs will ever owe more

borrowing spouse leaves the than the loan balance or

home or does not comply the value of the property,

with the loan terms, you may whichever is less; and your

choose to repay the loan at heir is not obligated to use

any time without incurring assets other than the home

additional costs. to repay the debt.

2 4

HUD Fee Limitations Financial Assessment

HECM loan origination fees HUD now requires a more

are regulated by HUD. Other thorough evaluation of

reverse mortgage costs may borrowers’ abilities to meet

vary among creditors and the financial obligations of

loan types. their reverse mortgage loans.

10