Page 3 - John Hundley 2017

P. 3

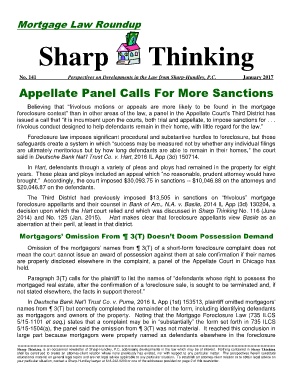

Mortgage Law Roundup

Sharp Thinking

No. 141 Perspectives on Developments in the Law from Sharp-Hundley, P.C. January 2017

Appellate Panel Calls For More Sanctions

Believing that “frivolous motions or appeals are more likely to be found in the mortgage

foreclosure context” than in other areas of the law, a panel in the Appellate Court’s Third District has

issued a call that “it is incumbent upon the courts, both trial and appellate, to impose sanctions for . . .

frivolous conduct designed to help defendants remain in their home, with little regard for the law.”

Foreclosure law imposes significant procedural and substantive hurdles to foreclosure, but those

safeguards create a system in which “success may be measured not by whether any individual filings

are ultimately meritorious but by how long defendants are able to remain in their homes,” the court

said in Deutsche Bank Nat’l Trust Co. v. Hart, 2016 IL App (3d) 150714.

In Hart, defendants through a variety of pleas and ploys had remained in the property for eight

years. These pleas and ploys included an appeal which “no reasonable, prudent attorney would have

brought.” Accordingly, the court imposed $30,093.75 in sanctions -- $10,046.88 on the attorneys and

$20,046.87 on the defendants.

The Third District had previously imposed $13,505 in sanctions on “frivolous” mortgage

foreclosure appellants and their counsel in Bank of Am., N.A. v. Basile, 2014 IL App (3d) 130204, a

decision upon which the Hart court relied and which was discussed in Sharp Thinking No. 116 (June

2014) and No. 125 (Jan. 2015). Hart makes clear that foreclosure appellants view Basile as an

aberration at their peril, at least in that district.

Mortgagors’ Omission From ¶ 3(T) Doesn’t Doom Possession Demand

Omission of the mortgagors’ names from ¶ 3(T) of a short-form foreclosure complaint does not

mean the court cannot issue an award of possession against them at sale confirmation if their names

are properly disclosed elsewhere in the complaint, a panel of the Appellate Court in Chicago has

held.

Paragraph 3(T) calls for the plaintiff to list the names of “defendants whose right to possess the

mortgaged real estate, after the confirmation of a foreclosure sale, is sought to be terminated and, if

not stated elsewhere, the facts in support thereof.”

In Deutsche Bank Nat’l Trust Co. v. Puma, 2016 IL App (1st) 153513, plaintiff omitted mortgagors’

names from ¶ 3(T) but correctly completed the remainder of the form, including identifying defendants

as mortgagors and owners of the property. Noting that the Mortgage Foreclosure Law (735 ILCS

5/15-1101 et seq.) states that a complaint may be in “substantially” the form set forth in 735 ILCS

5/15-1504(a), the panel said the omission from ¶ 3(T) was not material. It reached this conclusion in

large part because mortgagors were properly named as defendants elsewhere in the foreclosure

●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●

Sharp Thinking is an occasional newsletter of Sharp-Hundley, P.C. addressing developments in the law which may be of interest. Nothing contained in Sharp Thinking

shall be construed to create an attorney-client relation where none previously has existed, nor with respect to any particular matter. The perspectives herein constitute

educational material on general legal topics and are not legal advice applicable to any particular situation. To establish an attorney-client relation or to obtain legal advice on

your particular situation, contact a Sharp-Hundley lawyer at 618-242-0200 or one of the addresses provided on page 2 of this newsletter.