Page 57 - AR_NorthSuburbs_Mobile

P. 57

Do exemptions need to be renewed every year?

Most property owners do not need to renew their exemptions. A homeowner only needs to apply

for the Homeowner and Senior Exemptions once. These two exemptions are auto-renewed

thereafter as long as there is no change in eligibility.

In 2020, the Illinois state legislature proactively added one-year auto-renewals to support

homeowners during the COVID-19 pandemic. Any eligible homeowner who received the Senior

Freeze, Persons with Disabilities, or Veterans with Disabilities Exemptions in tax year 2019 (issued

in 2020) will have these exemptions automatically renewed in tax year 2020.

What if an exemption was missing from a second installment tax bill?

If a property owner has paid a second installment tax bill in full, but it was missing an exemption

they qualified for that tax year, the CCAO can help them correct this by filing a Certificate of Error.

Certificate of Error applications for missed exemptions can be submitted in person or online with

the CCAO. To learn more, visit cookcountyassessor.com/exemptions or call (312) 443-7550.

After the CCAO verifies the application, the Cook County Treasurer issues a refund check for the

missed property tax savings.

Summer Savings from Property Tax Exemptions

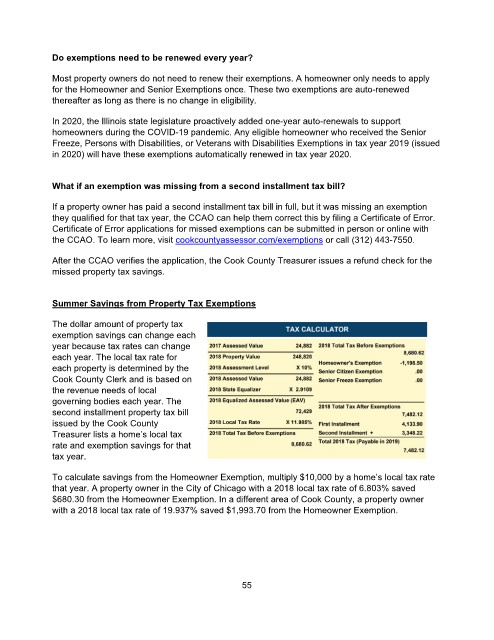

The dollar amount of property tax

exemption savings can change each

year because tax rates can change

each year. The local tax rate for

each property is determined by the

Cook County Clerk and is based on

the revenue needs of local

governing bodies each year. The

second installment property tax bill

issued by the Cook County

Treasurer lists a home’s local tax

rate and exemption savings for that

tax year.

To calculate savings from the Homeowner Exemption, multiply $10,000 by a home’s local tax rate

that year. A property owner in the City of Chicago with a 2018 local tax rate of 6.803% saved

$680.30 from the Homeowner Exemption. In a different area of Cook County, a property owner

with a 2018 local tax rate of 19.937% saved $1,993.70 from the Homeowner Exemption.

55