Page 22 - AR_NorthSuburbs

P. 22

Cap Rates: Third-Party Sources & CCAO

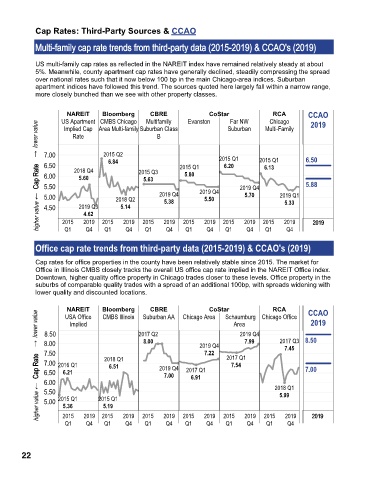

Multi-family cap rate trends from third-party data (2015-2019) & CCAO's (2019)

r

d

-

i

t

h

y

d

t

p

a

r

m

t

r

e

a

t

e

f

r

o

n

d

s

a

C

0

C

)

&

2

(

s

A

O

'

1

(

2

0

9

t

a

0

1

9

2

1

5

-

i

m

a

l

c

y

l

u

M Multi-family cap rate trends from third-party data (2015-2019) & CCAO's (2019) )

t

f

-

i

p

a

r

US multi-family cap rates as reflected in the NAREIT index have remained relatively steady at about

5%. Meanwhile, county apartment cap rates have generally declined, steadily compressing the spread

over national rates such that it now below 100 bp in the main Chicago-area indices. Suburban

apartment indices have followed this trend. The sources quoted here largely fall within a narrow range,

more closely bunched than we see with other property classes.

CBRE

NAREIT Bloomberg Multifamily Evanston CoStar Far NW Chicago CCAO

RCA

US Apartment CMBS Chicago

2019

→ lower value 7.00 Implied Cap Area Multi-family Suburban Class Suburban Multi-Family

Rate

B

2015 Q2

6.20

6.13

Cap Rate Cap Rate 6.50 2018 Q4 6.84 2015 Q3 2019 Q4 2015 Q1 2019 Q4 2015 Q1 2019 Q4 2015 Q1 6.50

5.80

6.00

5.60

5.63

5.88

5.50

5.70

higher value ← 5.00 2015 2019 Q3 2015 2018 Q2 2015 2019 2015 5.50 2015 2019 2015 2019 Q1 2 2019

5.38

5.33

5.14

4.50

4.62

2019

2019

2019

2019

0

1

9

Q4

Q1

Q4

Q1

Q1

Q1

Q4

Q4

Q4

Q1

Q1

Q4

Office cap rate trends from third-party data (2015-2019) & CCAO's (2019)

Cap rates for office properties in the county have been relatively stable since 2015. The market for

Office in Illinois CMBS closely tracks the overall US office cap rate implied in the NAREIT Office index.

Downtown, higher quality office property in Chicago trades closer to these levels. Office property in the

suburbs of comparable quality trades with a spread of an additional 100bp, with spreads widening with

lower quality and discounted locations.

NAREIT Bloomberg Suburban AA Chicago Area Schaumburg Chicago Office CCAO

CoStar

RCA

CBRE

→ lower value 8.50 Implied 2017 Q2 Area 2017 Q3 8.50

USA Office

CMBS Illinois

2019

2019 Q4

8.00

7.50 2018 Q1 8.00 2019 Q4 2017 Q1 7.99 7.45

7.22

Cap Rate Cap Rate 7.00 2016 Q1 6.51 2019 Q4 2017 Q1 7.54 7.00

6.50

6.21

7.00

6.91

6.00

higher value ← 5.50 2015 Q1 2015 Q1 2018 Q1

5.99

5.00

5.36

5.19

9

0

1

2015

Q4

Q1

Q4

Q1 2019 2015 2019 2015 2019 2015 2019 2015 2019 2015 2019 2 2019

Q4

Q1

Q4

Q1

Q4

Q1

Q4

Q1

22