Page 23 - AR_NorthSuburbs

P. 23

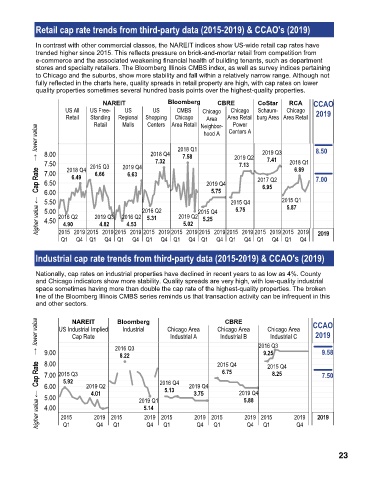

Retail cap rate trends from third-party data (2015-2019) & CCAO's (2019)

In contrast with other commercial classes, the NAREIT indices show US-wide retail cap rates have

trended higher since 2015. This reflects pressure on brick-and-mortar retail from competition from

e-commerce and the associated weakening financial health of building tenants, such as department

stores and specialty retailers. The Bloomberg Illinois CMBS index, as well as survey indices pertaining

to Chicago and the suburbs, show more stability and fall within a relatively narrow range. Although not

fully reflected in the charts here, quality spreads in retail property are high, with cap rates on lower

quality properties sometimes several hundred basis points over the highest-quality properties.

NAREIT Bloomberg CBRE CoStar RCA CCAO

US All US Free- US US CMBS Chicago Chicago Schaum- Chicago 2019

Retail Standing Regional Shopping Area Retail Neighbor- Area Retail burg Area Area Retail

Chicago

Area

Retail

Power

Centers

Malls

→ lower value 2018 Q1 hood A Centers A 2019 Q3 8.50

8.00

7.32

7.50 2018 Q4 2015 Q3 2019 Q4 2018 Q4 7.58 2019 Q2 7.41 2018 Q1

7.13

6.89

Cap Rate Cap Rate 7.00 6.49 6.66 6.63 2019 Q4 2017 Q2 7.00

6.50

6.95

5.75

6.00

higher value ← 5.50 2016 Q2 2019 Q3 2016 Q2 5.31 2019 Q2 2015 Q4 2015 Q4 2015 Q1

5.87

5.75

2016 Q2

5.00

5.25

4.50

5.02

4.53

4.82

4.90

2015 2019 2015 2019 2015 2019 2015 2019 2015 2019 2015 2019 2015 2019 2015 2019 2015 2019

1

0

9

Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 2 2019

Industrial cap rate trends from third-party data (2015-2019) & CCAO's (2019)

Nationally, cap rates on industrial properties have declined in recent years to as low as 4%. County

and Chicago indicators show more stability. Quality spreads are very high, with low-quality industrial

space sometimes having more than double the cap rate of the highest-quality properties. The broken

line of the Bloomberg Illinois CMBS series reminds us that transaction activity can be infrequent in this

and other sectors.

→ lower value 9.00 US Industrial Implied 2016 Q3 Chicago Area Chicago Area 2016 Q3 CCAO

CBRE

Bloomberg

NAREIT

Industrial

Chicago Area

2019

Cap Rate

Industrial C

Industrial B

Industrial A

9.58

9.25

8.22

Cap Rate Cap Rate 8.00 2015 Q3 2019 Q2 2016 Q4 2019 Q4 2015 Q4 2015 Q4 7.50

6.75

8.25

7.00

5.92

6.00

5.13

1

higher value ← 5.00 2015 4 4.01 Q1 2019 Q1 Q1 3 3.75 Q1 2019 Q4 Q1 2019 2 2019

.

0

.

5

7

5.88

4.00

5.14

0

2019 2015

2019 2015

2019 2015

1

2019 2015

9

Q4

Q4

Q4

Q4

Q1

Q4

23