Page 15 - Exposed Final

P. 15

Remember, you can spend money, but you can't spend average rates of

return. Let's start with a simple example:

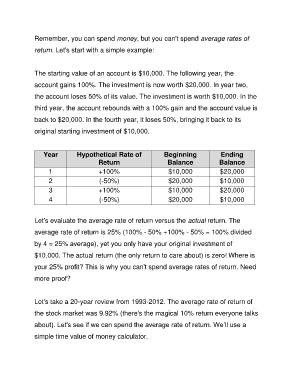

The starting value of an account is $10,000. The following year, the

account gains 100%. The investment is now worth $20,000. In year two,

the account loses 50% of its value. The investment is worth $10,000. In the

third year, the account rebounds with a 100% gain and the account value is

back to $20,000. In the fourth year, it loses 50%, bringing it back to its

original starting investment of $10,000.

Year Hypothetical Rate of Beginning Ending

Return Balance Balance

1 +100% $10,000 $20,000

2 (-50%) $20,000 $10,000

3 +100% $10,000 $20,000

4 (-50%) $20,000 $10,000

Let's evaluate the average rate of return versus the actual return. The

average rate of return is 25% (100% - 50% +100% - 50% = 100% divided

by 4 = 25% average), yet you only have your original investment of

$10,000. The actual return (the only return to care about) is zero! Where is

your 25% profit? This is why you can't spend average rates of return. Need

more proof?

Let's take a 20-year review from 1993-2012. The average rate of return of

the stock market was 9.92% (there's the magical 10% return everyone talks

about). Let's see if we can spend the average rate of return. We’ll use a

simple time value of money calculator.