Page 33 - Exposed Final

P. 33

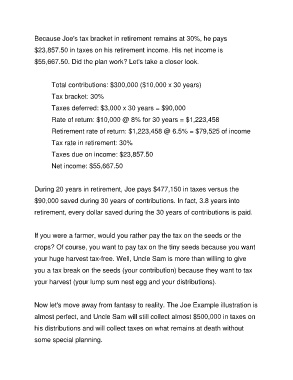

Because Joe's tax bracket in retirement remains at 30%, he pays

$23,857.50 in taxes on his retirement income. His net income is

$55,667.50. Did the plan work? Let's take a closer look.

Total contributions: $300,000 ($10,000 x 30 years)

Tax bracket: 30%

Taxes deferred: $3,000 x 30 years = $90,000

Rate of return: $10,000 @ 8% for 30 years = $1,223,458

Retirement rate of return: $1,223,458 @ 6.5% = $79,525 of income

Tax rate in retirement: 30%

Taxes due on income: $23,857.50

Net income: $55,667.50

During 20 years in retirement, Joe pays $477,150 in taxes versus the

$90,000 saved during 30 years of contributions. In fact, 3.8 years into

retirement, every dollar saved during the 30 years of contributions is paid.

If you were a farmer, would you rather pay the tax on the seeds or the

crops? Of course, you want to pay tax on the tiny seeds because you want

your huge harvest tax-free. Well, Uncle Sam is more than willing to give

you a tax break on the seeds (your contribution) because they want to tax

your harvest (your lump sum nest egg and your distributions).

Now let's move away from fantasy to reality. The Joe Example illustration is

almost perfect, and Uncle Sam will still collect almost $500,000 in taxes on

his distributions and will collect taxes on what remains at death without

some special planning.