Page 242 - Brook-Hollow Due Diligence Package

P. 242

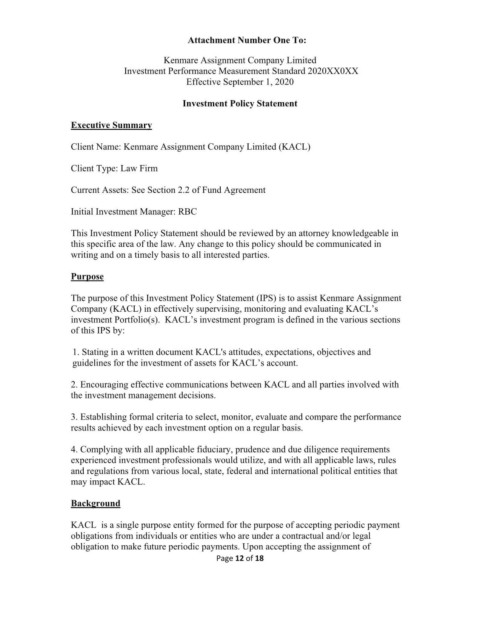

Attachment Number One To: obligation from the Obligor, KACL makes the future periodic payments as agreed

between the Obligor, the Payee and KACL.

Kenmare Assignment Company Limited

Investment Performance Measurement Standard 2020XX0XX Statement of Objectives

Effective September 1, 2020

This IPS has been arrived at upon consideration by KACL, and describes the investment

Investment Policy Statement process that KACL deems appropriate. This process includes offering various asset

classes and investment management styles that, in total, are expected to offer payees of

Executive Summary the assignment obligation the opportunity to diversify their investments in a manner

appropriate to their investment objectives and risk/return requirements.

Client Name: Kenmare Assignment Company Limited (KACL)

The objectives of the Payee’s Portfolios are:

Client Type: Law Firm

- Have the ability to meet future periodic payments as agreed between the obligor,

Current Assets: See Section 2.2 of Fund Agreement the Payee and assigned to KACL,

- Control costs of administering the plan and managing the investments,

Initial Investment Manager: RBC - Provide diversified mix of investments consistent with the goals and objectives of

the Payee, and

This Investment Policy Statement should be reviewed by an attorney knowledgeable in - Please refer to Exhibit A hereto for specific objectives of the overall portfolio.

this specific area of the law. Any change to this policy should be communicated in

writing and on a timely basis to all interested parties. Performance Expectations

Purpose The desired investment objectives will vary based upon the individual structure of the

assignment obligation and the Payee’s desired structure of underlying assets. The target

The purpose of this Investment Policy Statement (IPS) is to assist Kenmare Assignment rate of return for the Payee will be based upon the assumption that future real returns will

Company (KACL) in effectively supervising, monitoring and evaluating KACL’s approximate the long-term rates of return experienced for various asset classes. The

investment Portfolio(s). KACL’s investment program is defined in the various sections payee must understand that market performance varies and a rate of return may not be

of this IPS by: meaningful during some periods.

1. Stating in a written document KACL's attitudes, expectations, objectives and Accordingly, relative performance benchmarks for the investment options are set forth in

guidelines for the investment of assets for KACL’s account. the "Monitoring" section.

2. Encouraging effective communications between KACL and all parties involved with Duties and Responsibilities

the investment management decisions.

KACL

3. Establishing formal criteria to select, monitor, evaluate and compare the performance

results achieved by each investment option on a regular basis. The primary responsibilities of KACL are:

4. Complying with all applicable fiduciary, prudence and due diligence requirements 1. Prepare and maintain this investment policy statement.

experienced investment professionals would utilize, and with all applicable laws, rules

and regulations from various local, state, federal and international political entities that 2. Prudently diversify the plan’s assets to meet an agreed upon risk/return profile.

may impact KACL.

3. Prudently select investment options.

Background

4. Control and account for all investment, record keeping and administrative

KACL is a single purpose entity formed for the purpose of accepting periodic payment expenses associated with the plan.

obligations from individuals or entities who are under a contractual and/or legal

obligation to make future periodic payments. Upon accepting the assignment of

Page 12 of 18 Page 13 of 18