Page 247 - Brook-Hollow Due Diligence Package

P. 247

investment option's organization.

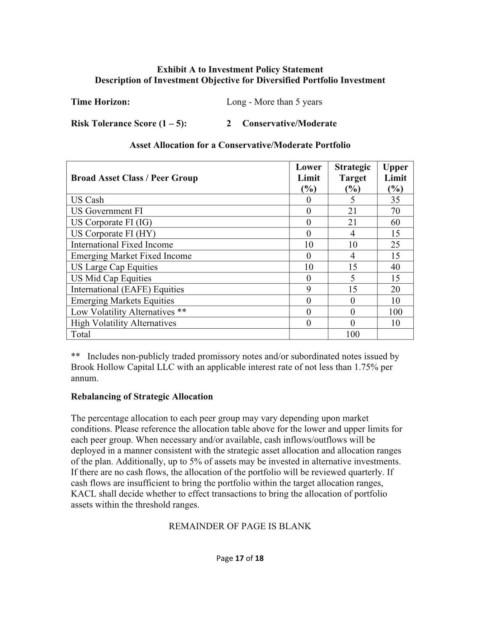

Monitoring – Benchmarks Exhibit A to Investment Policy Statement

Description of Investment Objective for Diversified Portfolio Investment

Performance benchmarks have been established for each investment option. Manager

performance will be evaluated in terms of an appropriate market index (e.g. the S&P 500 Time Horizon: Long - More than 5 years

stock index for large-cap domestic equity manager) and the relevant peer group (e.g. the

large-cap growth universe for a large-cap growth equity manager). Risk Tolerance Score (1 – 5): 2 Conservative/Moderate

Monitoring - Watch List Criteria Asset Allocation for a Conservative/Moderate Portfolio

The decision to retain or terminate an investment option cannot be made by a formula. Lower Strategic Upper

Also, extraordinary events do occur that may interfere with the investment option's ability Broad Asset Class / Peer Group Limit Target Limit

to prudently manage investment assets. It is KACL's confidence in the investment (%) (%) (%)

option's ability to perform in the future that ultimately determines the retention of an US Cash 0 5 35

investment option. An investment option may be placed on a Watch List and a thorough US Government FI 0 21 70

review and analysis of the investment option may be conducted, when: US Corporate FI (IG) 0 21 60

US Corporate FI (HY) 0 4 15

• One of the triggers defined above is tripped, and/or International Fixed Income 10 10 25

• Investment performance consistently underperformers Manager benchmarks. Emerging Market Fixed Income 0 4 15

US Large Cap Equities 10 15 40

US Mid Cap Equities 0 5 15

International (EAFE) Equities 9 15 20

REMAINDER OF PAGE IS BLANK Emerging Markets Equities 0 0 10

Low Volatility Alternatives ** 0 0 100

High Volatility Alternatives 0 0 10

Total 100

** Includes non-publicly traded promissory notes and/or subordinated notes issued by

Brook Hollow Capital LLC with an applicable interest rate of not less than 1.75% per

annum.

Rebalancing of Strategic Allocation

The percentage allocation to each peer group may vary depending upon market

conditions. Please reference the allocation table above for the lower and upper limits for

each peer group. When necessary and/or available, cash inflows/outflows will be

deployed in a manner consistent with the strategic asset allocation and allocation ranges

of the plan. Additionally, up to 5% of assets may be invested in alternative investments.

If there are no cash flows, the allocation of the portfolio will be reviewed quarterly. If

cash flows are insufficient to bring the portfolio within the target allocation ranges,

KACL shall decide whether to effect transactions to bring the allocation of portfolio

assets within the threshold ranges.

REMAINDER OF PAGE IS BLANK

Page 16 of 18 Page 17 of 18