Page 4 - ANJ Capital Market Presentation

P. 4

Real Estate Investment Trusts (REITs)

REITs are investment vehicles that own, operate and manage a portfolio of

income-generating properties for regular returns. They are the real estate equivalent of

mutual funds - just as mutual funds hold a portfolio of equity, debt and money market

instruments, REITs hold a portfolio of varied real estate assets. These are spread across

commercial complexes, office towers, shopping malls, exhibition centres, hotels, IT

parks, to name a few.

REITs invest normally in commercial property where there is a scope to earn regular

income in the form of rent.

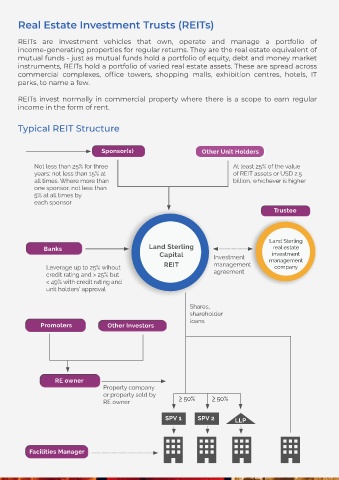

Typical REIT Structure

Sponsor(s) Other Unit Holders

Not less than 25% for three At least 25% of the value

years; not less than 15% at of REIT assets or USD 2.5

billion, whichever is higher

one sponsor, not less than

5% at all times by

each sponsor

Trustee

Land Sterling

Banks Land Sterling real estate

Capital Investment management

investment

Leverage up to 25% wihout REIT management company

credit rating and > 25% but agreement

< 49% with credit rating and

unit holders’ approval

Shares,

shareholder

loans

Promoters Other Investors

RE owner

Property company

or property sold by

RE owner 50% 50%

SPV 1 SPV 2 LLP

Facilities Manager