Page 153 - Washington Nonprofit Handbook 2018 Edition

P. 153

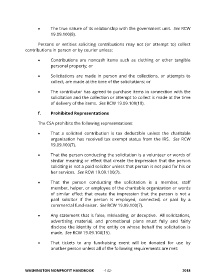

• The true nature of its relationship with the government unit. See RCW

19.09.100(8).

Persons or entities soliciting contributions may not (or attempt to) collect

contributions in person or by courier unless:

• Contributions are noncash items such as clothing or other tangible

personal property; or

• Solicitations are made in person and the collections, or attempts to

collect, are made at the time of the solicitations; or

• The contributor has agreed to purchase items in connection with the

solicitation and the collection or attempt to collect is made at the time

of delivery of the items. See RCW 19.09.100(18).

f. Prohibited Representations

The CSA prohibits the following representations:

• That a solicited contribution is tax deductible unless the charitable

organization has received tax exempt status from the IRS. See RCW

19.09.100(7).

• That the person conducting the solicitation is a volunteer or words of

similar meaning or effect that create the impression that the person

soliciting is not a paid solicitor unless that person is not paid for his or

her services. See RCW 19.09.100(7).

• That the person conducting the solicitation is a member, staff

member, helper, or employee of the charitable organization or words

of similar effect that create the impression that the person is not a

paid solicitor if the person is employed, connected, or paid by a

commercial fund-raiser. See RCW 19.09.100(7).

• Any statement that is false, misleading, or deceptive. All solicitations,

advertising material, and promotional plans must fully and fairly

disclose the identity of the entity on whose behalf the solicitation is

made. See RCW 19.09.100(15).

• That tickets to any fundraising event will be donated for use by

another person unless all of the following requirements are met:

WASHINGTON NONPROFIT HANDBOOK -142- 2018