Page 17 - increase your credit score

P. 17

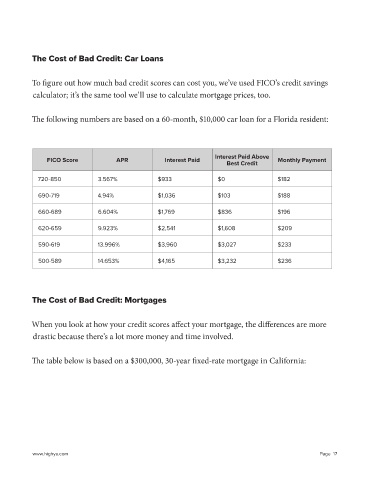

The Cost of Bad Credit: Car Loans

To figure out how much bad credit scores can cost you, we’ve used FICO’s credit savings

calculator; it’s the same tool we’ll use to calculate mortgage prices, too.

The following numbers are based on a 60-month, $10,000 car loan for a Florida resident:

Interest Paid Above

FICO Score APR Interest Paid Monthly Payment

Best Credit

720-850 3.567% $933 $0 $182

690-719 4.94% $1,036 $103 $188

660-689 6.604% $1,769 $836 $196

620-659 9.923% $2,541 $1,608 $209

590-619 13.996% $3,960 $3,027 $233

500-589 14.653% $4,165 $3,232 $236

The Cost of Bad Credit: Mortgages

When you look at how your credit scores affect your mortgage, the differences are more

drastic because there’s a lot more money and time involved.

The table below is based on a $300,000, 30-year fixed-rate mortgage in California:

www.highya.com Page 17