Page 18 - increase your credit score

P. 18

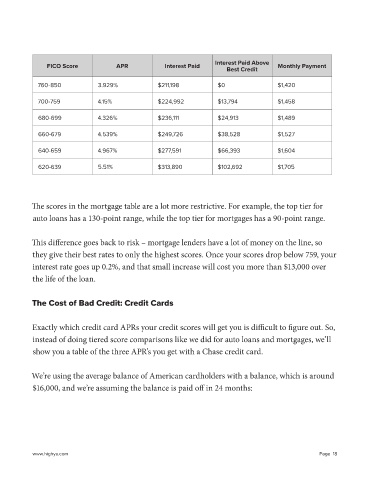

Interest Paid Above

FICO Score APR Interest Paid Monthly Payment

Best Credit

760-850 3.929% $211,198 $0 $1,420

700-759 4.15% $224,992 $13,794 $1,458

680-699 4.326% $236,111 $24,913 $1,489

660-679 4.539% $249,726 $38,528 $1,527

640-659 4.967% $277,591 $66,393 $1,604

620-639 5.51% $313,890 $102,692 $1,705

The scores in the mortgage table are a lot more restrictive. For example, the top tier for

auto loans has a 130-point range, while the top tier for mortgages has a 90-point range.

This difference goes back to risk – mortgage lenders have a lot of money on the line, so

they give their best rates to only the highest scores. Once your scores drop below 759, your

interest rate goes up 0.2%, and that small increase will cost you more than $13,000 over

the life of the loan.

The Cost of Bad Credit: Credit Cards

Exactly which credit card APRs your credit scores will get you is difficult to figure out. So,

instead of doing tiered score comparisons like we did for auto loans and mortgages, we’ll

show you a table of the three APR’s you get with a Chase credit card.

We’re using the average balance of American cardholders with a balance, which is around

$16,000, and we’re assuming the balance is paid off in 24 months:

www.highya.com Page 18