Page 27 - increase your credit score

P. 27

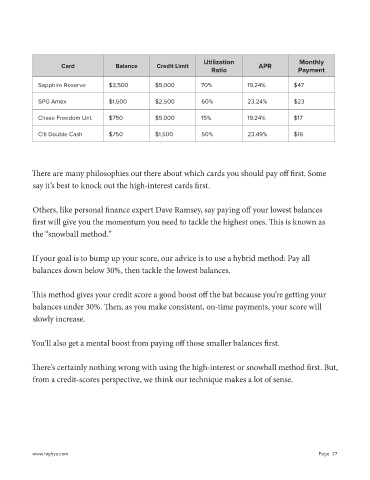

Utilization Monthly

Card Balance Credit Limit APR

Ratio Payment

Sapphire Reserve $3,500 $5,000 70% 19.24% $47

SPG Amex $1,500 $2,500 60% 23.24% $23

Chase Freedom Unl. $750 $5,000 15% 19.24% $17

Citi Double Cash $750 $1,500 50% 23.49% $16

There are many philosophies out there about which cards you should pay off first. Some

say it’s best to knock out the high-interest cards first.

Others, like personal finance expert Dave Ramsey, say paying off your lowest balances

first will give you the momentum you need to tackle the highest ones. This is known as

the “snowball method.”

If your goal is to bump up your score, our advice is to use a hybrid method: Pay all

balances down below 30%, then tackle the lowest balances.

This method gives your credit score a good boost off the bat because you’re getting your

balances under 30%. Then, as you make consistent, on-time payments, your score will

slowly increase.

You’ll also get a mental boost from paying off those smaller balances first.

There’s certainly nothing wrong with using the high-interest or snowball method first. But,

from a credit-scores perspective, we think our technique makes a lot of sense.

www.highya.com Page 27