Page 14 - Global EM Granola Best Practice Book - Draft Version 24

P. 14

1. Granola in Global Emerging Markets:

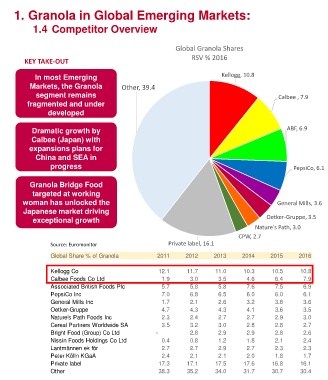

1.4 Competitor Overview

Global Granola Shares

RSV % 2016

KEY TAKE-OUT

In most Emerging Kellogg, 10.8

Markets, the Granola Other, 39.4

segment remains Calbee , 7.9

fragmented and under

developed

Dramatic growth by ABF, 6.9

Calbee (Japan) with

expansions plans for

China and SEA in

progress PepsiCo, 6.1

Granola Bridge Food

targeted at working

woman has unlocked the General Mills, 3.6

Japanese market driving

exceptional growth Oetker-Gruppe, 3.5

Nature's Path, 3.0

CPW, 2.7

Source: Euromonitor Private label, 16.1

Global Share % of Granola 2011 2012 2013 2014 2015 2016

Kellogg Co 12.1 11.7 11.0 10.3 10.5 10.8

Calbee Foods Co Ltd 1.9 3.0 3.5 4.6 6.4 7.9

Associated British Foods Plc 5.7 5.8 5.8 7.6 7.5 6.9

PepsiCo Inc 7.0 6.8 6.5 6.0 6.0 6.1

General Mills Inc 1.7 2.1 2.6 3.2 3.8 3.6

Oetker-Gruppe 4.7 4.3 4.3 4.1 3.6 3.5

Nature's Path Foods Inc 2.3 2.4 2.7 2.7 2.9 3.0

Cereal Partners Worldwide SA 3.5 3.2 3.0 2.8 2.8 2.7

Bright Food (Group) Co Ltd - 2.8 2.9 2.9 2.8 2.6

Nissin Foods Holdings Co Ltd 0.4 0.8 1.2 1.8 2.1 2.4

Lantmännen ek för 2.7 2.7 2.9 2.7 2.3 2.3

Peter Kölln KGaA 2.4 2.1 2.1 2.0 1.8 1.7

Private label 17.3 17.1 17.5 17.6 16.8 16.1

Other 38.3 35.2 34.0 31.7 30.7 30.4