Page 6 - your_guide_to_reverse_mortgages

P. 6

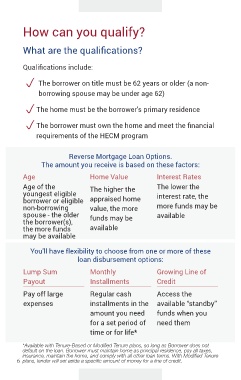

How can you qualify?

What are the qualifications?

Qualifications include:

p The borrower on title must be 62 years or older (a non-

borrowing spouse may be under age 62)

p The home must be the borrower’s primary residence

p The borrower must own the home and meet the financial

requirements of the HECM program

Reverse Mortgage Loan Options.

The amount you receive is based on these factors:

Age Home Value Interest Rates

Age of the The higher the The lower the

youngest eligible interest rate, the

borrower or eligible appraised home

non-borrowing value, the more more funds may be

spouse - the older funds may be available

the borrower(s),

the more funds available

may be available

You’ll have flexibility to choose from one or more of these

loan disbursement options:

Lump Sum Monthly Growing Line of

Payout Installments Credit

Pay off large Regular cash Access the

expenses installments in the available “standby”

amount you need funds when you

for a set period of need them

time or for life*

*Available with Tenure-Based or Modified Tenure plans, so long as Borrower does not

default on the loan. Borrower must maintain home as principal residence, pay all taxes,

insurance, maintain the home, and comply with all other loan terms. With Modified Tenure

6 plans, lender will set aside a specific amount of money for a line of credit.