Page 183 - ACCESS BANK ANNUAL REPORTS_eBook

P. 183

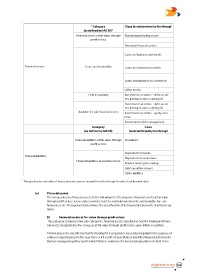

"Category Class (as determined by the Group)

(as defined by IaS 39)"

Financial assets at fair value through Non pledged trading assets

profit or loss

Derivative financial assets

Cash and balances with banks

Financial assets Loans and receivables Loans and advances to banks

Loans and advances to customers

Other assets

Held to maturity Investment securities - debt securi-

ties (pledged and non pledged)

Investment securities - debt securi-

ties (pledged and non pledged)

Available for sale financial assets Investment securities - equity secu-

rities

Investment under management

Category Class

(as defined by IaS 39) (as determined by the Group)

Financial liabilities at fair value through Derivatives

profit or loss

Deposits from banks

Financial liabilities

Deposits from customers

Financial liabilities at amortised cost

Interest bearing borrowings

Debt securities issued

Other liabilities

The purchases and sales of financial assets are accounted for in the Group’s books at settlement date.

(a) Financial assets

The Group allocates financial assets to the following IAS 39 categories: financial assets at fair value

through profit or loss; loans and receivables; held-to-maturity investments; and available-for-sale

financial assets. Management determines the classification of its financial instruments at initial recog-

nition.

[i] Financial assets at fair value through profit or loss

This category comprises two sub-categories: financial assets classified as held for trading and finan-

cial assets designated by the Group as at fair value through profit or loss upon initial recognition.

A financial asset is classified as held for trading if it is acquired or incurred principally for the purpose of

selling or repurchasing it in the near term or if it is part of a portfolio of identified financial instruments

that are managed together and for which there is evidence of a recent actual pattern of short-term

Access BAnk Plc 183

Annual Report & Accounts 2017