Page 207 - ACCESS BANK ANNUAL REPORTS_eBook

P. 207

Investment 281,626 Adjusted Aver- 295,708 267,545 292,414 270,836 The higher

in CRC fair value age P/B the illiquid-

comparison multiples of ity ratio

approach comparable and the

companies earnings

per share

haircut

adjustment

the higher

the fair

value

Nigerian 93,186 Adjusted Aver- 97,845 88,526 97,845 88,526 The higher

Mortage fair value age P/B the illiquid-

Refinance comparison multiples of ity ratio

Company approach comparable and the

companies earnings

per share

haircut

adjustment

the higher

the fair

value

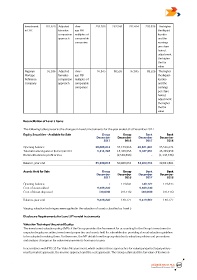

Reconciliation of Level 3 Items

The following tables presents the changes in Level 3 instruments for the year ended 31st December 2017

Equity Securities - Available for Sale Group Group Bank Bank

December December December December

2017 2016 2017 2016

Opening balance 50,069,031 37,159,966 49,821,881 35,516,671

Total unrealised gains or (losses) in OCI 5,111,787 15,449,958 5,107,631 15,449,958

Reclassification to profit or loss - (2,540,893) - (1,144,748)

Balance, year end 55,180,818 50,069,031 54,929,512 49,821,881

Assets Held for Sale Group Group Bank Bank

December December December December

2017 2016 2017 2016

Opening balance - 179,843 140,727 179,843

Cost of asset added 9,369,240 - 9,369,240 -

Cost of Asset disposed (30,000) (39,116) (30,000) (39,116)

Balance, year end 9,339,240 140,727 9,479,967 140,727

Varying valuation techniques were applied in the valuation of assets classified as Level 3

Disclosure Requirements for Level 3 Financial Instruments

Valuation Technique Unquoted Equity:

The investment valuation policy (IVP) of the Group provides the framework for accounting for the Group’s investment in

unquoted equity securities, investment properties and assets held for sale while also providing a broad valuation guideline

to be adopted in valuing them. Furthermore, the IVP details how the group decides its valuation policies and procedures

and analysis changes in fair value measurements from year to year.

In accordance with IFRS 13 Fair Value Measurement, which outlines three approaches for valuing unquoted equity instru-

ments; market approach, the income approach and the cost approach. The Group estimated the fair value of its invest-

Access BAnk Plc 207

Annual Report & Accounts 2017