Page 210 - ACCESS BANK ANNUAL REPORTS_eBook

P. 210

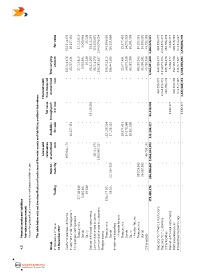

Fair value 953,944,176 20,257,131 37,743,819 9,050,894 59,348 93,419,293 101,523,651 2,045,074,534 246,994,559 150,221,856 29,977,451 54,079,368 69,581,098 87,203,365 36,590,582 46,799,196 3,982,520,321 450,196,970 2,244,879,075 235,786,478 5,332,177 290,548,781 311,349,297 3,538,092,778

Total carrying amount 953,944,176 20,257,131 37,743,819 9,050,894 59,348 93,419,293 68,114,076 1,995,987,627 258,672,815 188,441,589 29,977,451 54,079,368 69,581,098 88,203,365 36,590,582 46,799,196 3,950,921,828 450,196,970 2,244,879,075 235,786,478 5,332,177 302,106,706 311,617,187 3,549,918,593

Financial Liabil- ities measured at amortized cost - - - - - - - - - - - - - - - - - 450,196,970 2,244,879,075 235,786,478 - 302,106,706 311,617,187 3,544,589,416

the table below sets out the classification of each class of financial assets and liabilities, and their fair values.

Fair value through prof- it or loss 93,419,293 93,419,293 5,332,177 5,332,177

- - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - -

Available- for-sale 20,257,131 27,108,115 29,977,451 54,079,368 69,581,098

132,195,254 333,198,417

Loans and receivables at amortized 953,944,176 68,114,076 1,995,987,627 46,799,196

cost - - - - - - - - - - - - - - - - - - -

3,064,845,075

Held-to- maturity - - - - - - - - - 161,264,920 - - - 88,203,365 36,590,582 - 286,058,867 - - - - - -

Accounting classification measurement basis and fair values

Trading - - 37,743,819 9,050,894 59,348 - - - 126,477,561 68,554 - - - - - - 173,400,176 - - - - - - -

Financial assets and liabilities Fair value measurement Cash and balances with banks Investment under management Treasury bills Derivative financial instruments Loans and advances to banks Loans and advances to customers Treasury bills - Available for sale Treasury bills - Held to Maturity Treasury bills Deposits from financial institutions Derivative financial instruments Interest bearing borrowings

4.3 Group In thousands of Naira 31 December 2017 Non pledged trading assets Bonds Equity Pledged assets Bonds Investment securities Bonds Equity Bonds Other assets Deposits from customers Other liabilities Debt securities issued

210 Access BAnk Plc

Annual Report & Accounts 2017