Page 15 - MFX Reversal Patterns C.M

P. 15

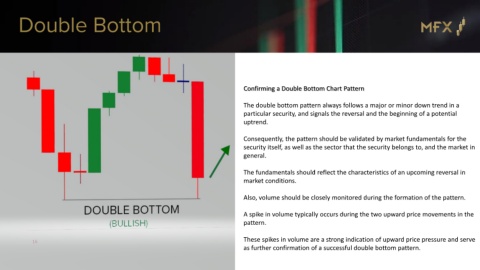

Double Bottom

Confirming a Double Bottom Chart Pattern

The double bottom pattern always follows a major or minor down trend in a

particular security, and signals the reversal and the beginning of a potential

uptrend.

Consequently, the pattern should be validated by market fundamentals for the

security itself, as well as the sector that the security belongs to, and the market in

general.

The fundamentals should reflect the characteristics of an upcoming reversal in

market conditions.

Also, volume should be closely monitored during the formation of the pattern.

A spike in volume typically occurs during the two upward price movements in the

pattern.

These spikes in volume are a strong indication of upward price pressure and serve

16

as further confirmation of a successful double bottom pattern.