Page 10 - MFX Reversal Patterns C.M

P. 10

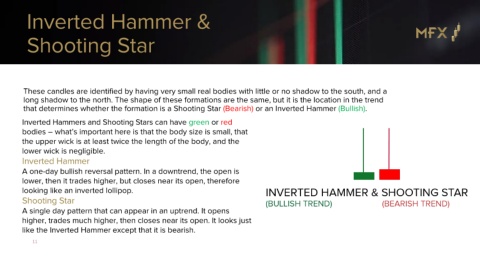

Inverted Hammer &

Shooting Star

These candles are identified by having very small real bodies with little or no shadow to the south, and a

long shadow to the north. The shape of these formations are the same, but it is the location in the trend

that determines whether the formation is a Shooting Star (Bearish) or an Inverted Hammer (Bullish).

Inverted Hammers and Shooting Stars can have green or red

bodies – what’s important here is that the body size is small, that

the upper wick is at least twice the length of the body, and the

lower wick is negligible.

Inverted Hammer

A one-day bullish reversal pattern. In a downtrend, the open is

lower, then it trades higher, but closes near its open, therefore

looking like an inverted lollipop.

Shooting Star

A single day pattern that can appear in an uptrend. It opens

higher, trades much higher, then closes near its open. It looks just

like the Inverted Hammer except that it is bearish.

11