Page 5 - MFX Reversal Patterns C.M

P. 5

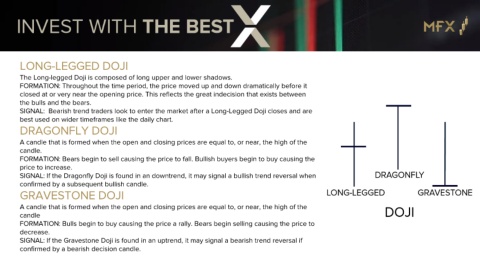

LONG-LEGGED DOJI

The Long-legged Doji is composed of long upper and lower shadows.

FORMATION: Throughout the time period, the price moved up and down dramatically before it

closed at or very near the opening price. This reflects the great indecision that exists between

the bulls and the bears.

SIGNAL: Bearish trend traders look to enter the market after a Long-Legged Doji closes and are

best used on wider timeframes like the daily chart.

DRAGONFLY DOJI

A candle that is formed when the open and closing prices are equal to, or near, the high of the

candle.

FORMATION: Bears begin to sell causing the price to fall. Bullish buyers begin to buy causing the

price to increase.

SIGNAL: If the Dragonfly Doji is found in an downtrend, it may signal a bullish trend reversal when

confirmed by a subsequent bullish candle.

GRAVESTONE DOJI

A candle that is formed when the open and closing prices are equal to, or near, the high of the

candle

FORMATION: Bulls begin to buy causing the price a rally. Bears begin selling causing the price to

decrease.

SIGNAL: If the Gravestone Doji is found in an uptrend, it may signal a bearish trend reversal if

confirmed by a bearish decision candle.