Page 177 - RFHL ANNUAL REPORT 2024_ONLINE

P. 177

175

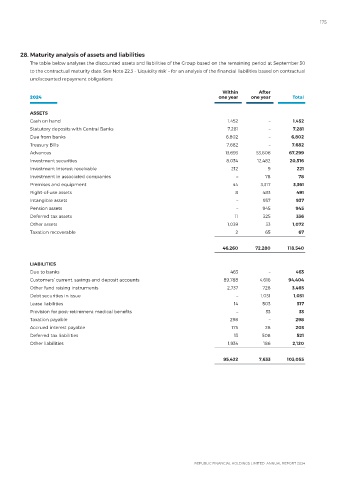

28. Maturity analysis of assets and liabilities

The table below analyses the discounted assets and liabilities of the Group based on the remaining period at September 30

to the contractual maturity date. See Note 22.3 - ‘Liquidity risk’ – for an analysis of the financial liabilities based on contractual

undiscounted repayment obligations.

Within After

2024 one year one year Total

ASSETS

Cash on hand 1,452 – 1,452

Statutory deposits with Central Banks 7,281 – 7,281

Due from banks 6,802 – 6,802

Treasury Bills 7,682 – 7,682

Advances 13,693 53,606 67,299

Investment securities 8,034 12,482 20,516

Investment interest receivable 212 9 221

Investment in associated companies – 78 78

Premises and equipment 44 3,317 3,361

Right-of-use assets 8 483 491

Intangible assets – 937 937

Pension assets – 945 945

Deferred tax assets 11 325 336

Other assets 1,039 33 1,072

Taxation recoverable 2 65 67

46,260 72,280 118,540

LIABILITIES

Due to banks 463 – 463

Customers’ current, savings and deposit accounts 89,788 4,616 94,404

Other fund raising instruments 2,737 728 3,465

Debt securities in issue – 1,031 1,031

Lease liabilities 14 503 517

Provision for post-retirement medical benefits – 33 33

Taxation payable 298 – 298

Accrued interest payable 175 28 203

Deferred tax liabilities 13 508 521

Other liabilities 1,934 186 2,120

95,422 7,633 103,055