Page 178 - RFHL ANNUAL REPORT 2024_ONLINE

P. 178

176 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

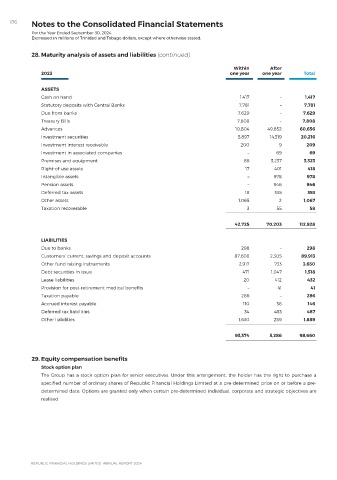

28. Maturity analysis of assets and liabilities (continued)

Within After

2023 one year one year Total

ASSETS

Cash on hand 1,417 – 1,417

Statutory deposits with Central Banks 7,781 – 7,781

Due from banks 7,629 – 7,629

Treasury Bills 7,808 – 7,808

Advances 10,804 49,852 60,656

Investment securities 5,897 14,319 20,216

Investment interest receivable 200 9 209

Investment in associated companies – 69 69

Premises and equipment 86 3,237 3,323

Right-of-use assets 17 401 418

Intangible assets – 978 978

Pension assets – 946 946

Deferred tax assets 18 335 353

Other assets 1,065 2 1,067

Taxation recoverable 3 55 58

42,725 70,203 112,928

LIABILITIES

Due to banks 298 – 298

Customers’ current, savings and deposit accounts 87,608 2,305 89,913

Other fund raising instruments 2,917 733 3,650

Debt securities in issue 471 1,047 1,518

Lease liabilities 20 412 432

Provision for post-retirement medical benefits – 41 41

Taxation payable 286 – 286

Accrued interest payable 110 36 146

Deferred tax liabilities 34 453 487

Other liabilities 1,630 259 1,889

93,374 5,286 98,660

29. Equity compensation benefits

Stock option plan

The Group has a stock option plan for senior executives. Under this arrangement, the holder has the right to purchase a

specified number of ordinary shares of Republic Financial Holdings Limited at a pre-determined price on or before a pre-

determined date. Options are granted only when certain pre-determined individual, corporate and strategic objectives are

realised.