Page 36 - Bloomberg Businessweek July 2018

P. 36

Bloomberg Businessweek July 2, 2018

The survey’s accuracy was

meaningless; traders just

needed to know the results

before they went public

the British pound and bank stocks down sharply. Hedge funds that if the Scottish campaign had moved markets, a vote on

quickly began phoning the pollster. If YouGov was conduct- the U.K.’s membership in the world’s largest trading bloc might

ing another poll before the vote, traders said, they’d be will- shake them to their core. YouGov started getting hedge fund

ing to pay for a heads-up just 30 minutes to an hour before calls right away, according to sources familiar with the matter.

publication, according to two knowledgeable sources. Since So did other polling companies.

news of a new poll alone likely would move markets, the sur- Preelection polling was a given, but there were potential

vey’s accuracy was meaningless; traders just needed to know obstacles to hedge fund exit polls. For starters, the major

the results before the public did. YouGov rejected these offers, U.K. broadcasters normally air the results of a single, offi-

the insiders said. cial exit poll at 10 p.m., immediately after voting closes. If

Survation saw opportunities. It organized and sold last- this happened for Brexit, it might negate some of the advan-

minute tracking polls and a syndicated exit poll for the Scottish tages hedge funds had from private polls by giving the world

referendum to some of the world’s biggest hedge funds, accord- definitive information at 10 p.m. That’s because the official

ing to three knowledgeable sources. Clients included Brevan exit poll—jointly funded by the BBC, Sky, and ITV, and based 39

Howard Asset Management, then managing about $37 billion; on 20,000 face-to-face interviews—is the authoritative projec-

Tudor Investment; and Nomura Holdings, according to one tion of the day’s voting. It correctly predicted the last four

knowledgeable source. Brevan Howard, Tudor, and Nomura U.K. general elections.

declined to comment for this story. The face of the broadcasters’ election-night exit poll, its

The morning after the vote, it was clear that Scottish vot- chief designer and interpreter, is a 64-year-old Scottish profes-

ers had rejected independence overwhelmingly. The YouGov sor named John Curtice. He enjoys a rare level of trust across

poll that had sparked the most turmoil had missed the mark party lines and a cult following among political junkies. After

by 6 points. Survation’s private exit poll, however, was accu- the government set a referendum date, Curtice spoke with

rate enough that its clients had what they needed to profit, broadcasters and they decided the usual exit poll wasn’t fea-

according to knowledgeable sources. A lucrative line of busi- sible. They’d made the same call for Scotland. Curtice would

ness was born for two industries. later tell BBC viewers that his predictive models relied on

In 2015, the Conservatives, under David Cameron, swept to a comparable vote, and for Brexit there was none, making

dominance in the U.K.’s general election. Cameron had prom- a credible exit poll an expensive and difficult proposition.

ised to hold a referendum on the nation’s membership in the However, hedge funds were spending the money to line up

European Union if he won. Hedge funds realized immediately their own private polls—and Curtice was involved.

He told Bloomberg that polling company ICM Unlimited

paid him for his work on behalf of a hedge fund called Rokos

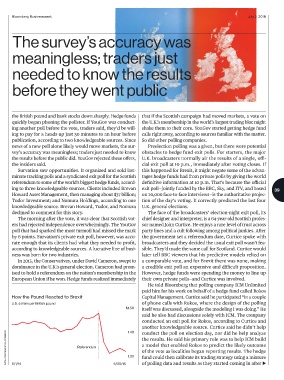

How the Pound Reacted to Brexit Capital Management. Curtice said he participated “in a couple

U.S. dollars per British pound of phone calls with Rokos, where the design of the polling

$ 1.50 itself was discussed, alongside the modeling I was doing.” He

said he also had discussions solely with ICM. The company

conducted an exit poll for Rokos, according to Curtice and

1.40 another knowledgeable source. Curtice said he didn’t help

conduct the poll on election day, nor did he help analyze

DATA: COMPILED BY BLOOMBERG 6/1/16 Referendum 6/30/16 1.30 the results. He said his primary role was to help ICM build

a model that enabled Rokos to predict the likely outcome

of the vote as localities began reporting results. The hedge

fund could then calibrate its trading strategy using a mixture

of polling data and results as they started coming in after