Page 14 - IPO Analysis - Private Equity Exits 2017_Final

P. 14

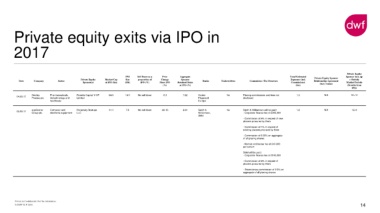

Private equity exits via IPO in

2017

Private Equity

IPO Sell Down as a Price Aggregate Total Estimated Sponsor lock-up

Private Equity Market Cap Size proportion of Change Sponsor Expenses (incl. Private Equity Sponsor + Orderly

Date Company Sector Banks Underwritten Commission / Fee Structure Relationship Agreement

Sponsor(s) at IPO (£m) (£M) IPO (%) Since IPO Retained Stake Commissions) (Key Terms) Market Periods

(%) at IPO (%) (£m) (Months from

IPO)

Destiny Pharmaceuticals, Rosetta Capital V GP 64.5 14.0 No sell down -6.3 7.62 Cantor No Placing commissions and fees not 1.3 N/A 12+12

04.09.17

Pharma plc biotechnology and Limited Fitzgerald disclosed

healthcare Europe

appScatter Computer and Perpetuity Startups 41.1 7.8 No sell down -26.15 2.61 Smith & No Smith & Williamson will be paid: 1.2 N/A 12+0

05.09.17

Group plc electronic equipment LLC Williamson, - Corporate finance fee of £205,000

Stifel

- Commission of 4% in respect of new

placees procured by them

- Commission of 1% in respect of

existing placees procured by them

- Commission of 0.65% on aggregate

of all placing shares

- Nomad and broker fee of £40,000

per annum

Stifel will be paid:

- Corporate finance fee of £100,000

- Commission of 4% in respect of

placees procured by them

- Discretionary commission of 0.5% on

aggregate of all placing shares

Private & Confidential. Not for distribution.

© DWF LLP 2018 14