Page 15 - IPO Analysis - Private Equity Exits 2017_Final

P. 15

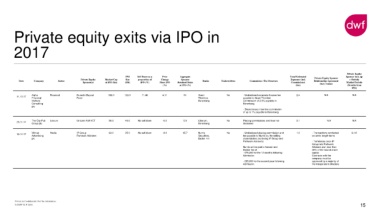

Private equity exits via IPO in

2017

Private Equity

IPO Sell Down as a Price Aggregate Total Estimated Sponsor lock-up

Private Equity Market Cap Size proportion of Change Sponsor Expenses (incl. Private Equity Sponsor + Orderly

Date Company Sector Banks Underwritten Commission / Fee Structure Relationship Agreement

Sponsor(s) at IPO (£m) (£M) IPO (%) Since IPO Retained Stake Commissions) (Key Terms) Market Periods

(%) at IPO (%) (£m) (Months from

IPO)

Alpha Financial Dunedin Buyout 163.0 123.0 71.46 4.11 Nil Grant No - Undisclosed corporate finance fee 2.4 N/A N/A

11.10.17

Financial Fund Thornton, payable to Grant Thornton

Markets Berenberg Commission of 2.5% payable to

Consulting Berenberg

plc

- Discretionary incentive commission

of up to 1% payable to Berenberg

The City Pub Leisure Unicorn AIM VCT 96.0 46.6 No sell down -6.0 5.9 Liberum, No Placing commissions and fees not 2.1 N/A N/A

23.11.17

Group plc Berenberg disclosed

Mirriad Media IP Group 63.2 25.0 No sell down -8.0 45.7 Numis No - Undisclosed placing commission and 1.2 - Transactions conducted 6+12

19.12.17

Advertising Parkwalk Advisers Securities, fee payable to Numis by the selling on arm's length terms

plc Baden Hill shareholders (not being IP Group and

Parkwalk Advisers) - Terminates once IP

Group and Parkwalk

Numis will be paid a Nomad and Advisers own less than

Broker fee of: 30% of the issued share

- £75,000 for the 12 months following capital

Admission Contracts with the

company must be

- £85,000 for the second year following approved by a majority of

Admission the independent directors

Private & Confidential. Not for distribution.

© DWF LLP 2018 15