Page 56 - Annual Review 2015-2016

P. 56

Notes to the Financial Statements

Year ended 30 April 2016

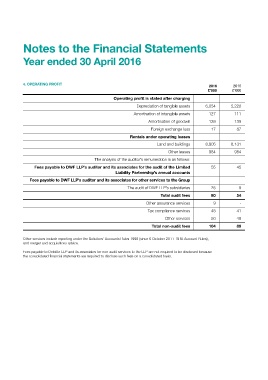

4. OPERATING PROFIT

2016 2015

£’000 £’000

Operating profit is stated after charging

Depreciation of tangible assets 6,054 5,220

Amortisation of intangible assets 127 111

Amortisation of goodwill 139 139

Foreign exchange loss 17 87

Rentals under operating leases

Land and buildings 8,805 8,131

Other leases 984 984

The analysis of the auditor’s remuneration is as follows:

Fees payable to DWF LLP’s auditor and its associates for the audit of the Limited 55 45

Liability Partnership’s annual accounts

Fees payable to DWF LLP’s auditor and its associates for other services to the Group

The audit of DWF LLP’s subsidiaries 25 9

Total audit fees 80 54

Other assurance services 9 -

Tax compliance services 45 41

Other services 50 48

Total non-audit fees 104 89

Other services include reporting under the Solicitors’ Accounts Rules 1998 (since 6 October 2011- SRA Account Rules),

and merger and acquisitions advice.

Fees payable to Deloitte LLP and its associates for non-audit services to the LLP are not required to be disclosed because

the consolidated financial statements are required to disclose such fees on a consolidated basis.