Page 57 - Annual Review 2015-2016

P. 57

57

Notes to the Financial Statements FINANCIAL REVIEW

Year ended 30 April 2016

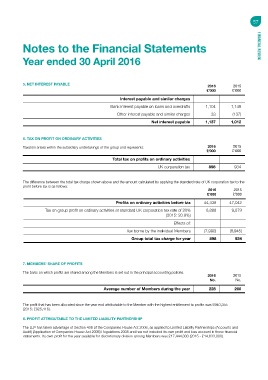

5. NET INTEREST PAYABLE

2016 2015

£’000 £’000

Interest payable and similar charges

Bank interest payable on loans and overdrafts 1,104 1,149

Other interest payable and similar charges 33 (137)

Net interest payable 1,137 1,012

6. TAX ON PROFIT ON ORDINARY ACTIVITIES

Taxation arises within the subsidiary undertakings of the group and represents: 2016 2015

£’000 £’000

Total tax on profits on ordinary activities

UK corporation tax 898 934

The difference between the total tax charge shown above and the amount calculated by applying the standard rate of UK corporation tax to the

profit before tax is as follows:

2016 2015

£’000 £’000

Profits on ordinary activities before tax 44,439 47,042

Tax on group profit on ordinary activities at standard UK corporation tax rate of 20% 8,888 9,879

(2015: 20.9%)

Effects of:

Tax borne by the individual Members (7,990) (8,945)

Group total tax charge for year 898 934

7. MEMBERS’ SHARE OF PROFITS

The basis on which profits are shared among the Members is set out in the principal accounting policies.

2016 2015

No. No.

Average number of Members during the year 228 260

The profit that has been allocated since the year end attributable to the Member with the highest entitlement to profits was £940,355

(2015: £925,416).

8. PROFIT ATTRIBUTABLE TO THE LIMITED LIABILITY PARTNERSHIP

The LLP has taken advantage of Section 408 of the Companies House Act 2006, as applied to Limited Liability Partnerships (Accounts and

Audit) (Application of Companies House Act 2006) Regulations 2008 and has not included its own profit and loss account in these financial

statements. Its own profit for the year available for discretionary division among Members was £17,444,000 (2015 - £14,633,000).