Page 66 - Annual Review 2015-2016

P. 66

Notes to the Financial Statements

Year ended 30 April 2016

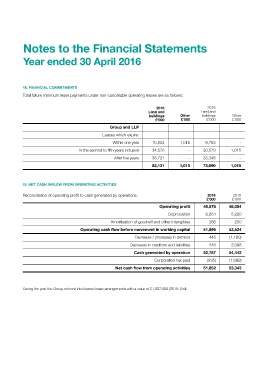

18. FINANCIAL COMMITMENTS

Total future minimum lease payments under non-cancellable operating leases are as follows:

2016 2015

Land and Land and

buildings Other buildings Other

£’000 £’000 £’000 £’000

Group and LLP

Leases which expire:

Within one year 10,834 1,015 9,763 -

In the second to fifth years inclusive 34,576 - 30,579 1,015

After five years 36,721 - 33,348 -

82,131 1,015 73,690 1,015

19. NET CASH INFLOW FROM OPERATING ACTIVITIES

Reconciliation of operating profit to cash generated by operations: 2016 2015

£’000 £’000

Operating profit 45,576 48,054

Depreciation 6,054 5,220

Amortisation of goodwill and other intangibles 266 250

Operating cash flow before movement in working capital 51,896 53,524

Decrease / (increase) in debtors 445 (1,180)

Decrease in creditors and liabilities 446 2,098

Cash generated by operation 52,787 54,442

Corporation tax paid (935) (1,099)

Net cash flow from operating activities 51,852 53,343

During the year the Group entered into finance lease arrangements with a value of £1,057,000 (2015: £nil).