Page 67 - Annual Review 2015-2016

P. 67

67

Notes to the Financial Statements FINANCIAL REVIEW

Year ended 30 April 2016

20. CONTROLLING PARTY AND RELATED PARTY TRANSACTIONS

In the opinion of the Members there is no controlling party as defined by FRS 102 Section 33.

DWF LLP has relied upon the exemption given in FRS 102 section 33 to not disclose transactions between itself and its 100% subsidiary

undertakings or other entities wholly included within the consolidation.

The Group considers Strategic Board Members as the key management personnel. The total remuneration for key management personnel

for the year total £3,438,000 (2015: £4,082,293).

21. EXPLANATION OF TRANSITION TO FRS 102

This is the first year that the Group has presented its financial statements under Financial Reporting Standard 102 (FRS 102) issued by the

Financial Reporting Council. The following disclosures are required in the year of transition. The last financial statements under previous UK

GAAP were for the year ended 30 April 2015 and the date of transition to FRS 102 was therefore 1 May 2014. As a consequence of adopting

FRS 102, a number of accounting policies have changed to comply with that standard.

Note 1. In the previously reported financial statements, which were presented under old UK GAAP, there was no requirement to include an

accrual for unpaid holiday entitlement. Under FRS 102, this approach is not permitted and the group is required to provide for any holiday

accrued from 1 December, the start of the group’s holiday year, to 30 April, which had not yet been taken by employees of the group. This has

resulted in an additional staff expense on transition and for each year reported.

Note 2. The Group has also been required to recalculate the lease incentives received since transition to spread the incentive over the full

lease term. Under old UK GAAP the lease incentive was spread to the first break clause. This has resulted in the reversal of £87,000 previously

recognised incentives credit. The Group has elected to continue to recognise existing lease incentives which commenced prior to the date of

transition to FRS 102, on the same basis used under the previous accounting framework as permitted under the transition exemptions of FRS 102.

Note 3. The adjustment to the tax charge has arisen as a direct result of the FRS 102 adjustments.

Note 4. In accordance with the Statement of Recommended Practice Accounting by Limited Liability Partnership (issued July 2014) the Group

now accounts for Members’ remuneration charged as an expense as documented in Note 1 to the financial statements.

Group LLP

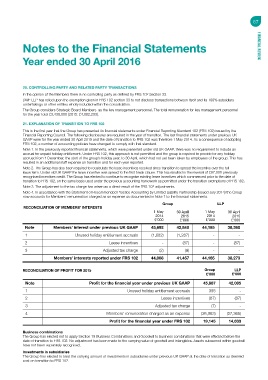

RECONCILIATION OF MEMBERS’ INTERESTS

1 May 30 April 1 May 30 April

2014 2015 2014 2015

£’000 £’000 £’000 £’000

Note Members’ interest under previous UK GAAP 45,692 42,840 44,165 38,360

1 Unused holiday entitlement accruals (1,682) (1,287) - -

2 Lease incentives - (87) - (87)

3 Adjusted tax charge (2) (9) - -

Members’ interests reported under FRS 102 44,008 41,457 44,165 38,273

RECONCILIATION OF PROFIT FOR 2015 Group LLP

£’000 £’000

Note Profit for the financial year under previous UK GAAP 45,807 42,085

1 Unused holiday entitlement accruals 395 -

2 Lease incentives (87) (87)

3 Adjusted tax charge (7) -

4 Members' remuneration charged as an expense (26,963) (27,365)

Profit for the financial year under FRS 102 19,145 14,633

Business combinations

The Group has elected not to apply Section 19 Business Combinations and Goodwill to business combinations that were effected before the

date of transition to FRS 102. No adjustment has been made to the carrying value of goodwill and intangibles. Assets subsumed within goodwill

have not been separately recognised.

Investments in subsidiaries

The Group has elected to treat the carrying amount of investments in subsidiaries under previous UK GAAP at the date of transition as deemed

cost on transition to FRS 102.