Page 6 - tmp

P. 6

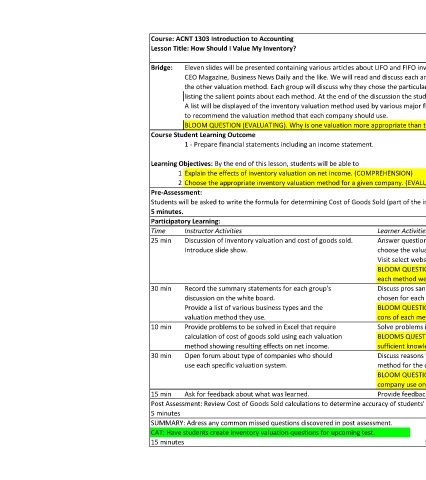

Course: ACNT 1303 Introduction to Accounting

Lesson Title: How Should I Value My Inventory?

Bridge: Eleven slides will be presented containing various articles about LIFO and FIFO inventory valuation systems. The articles were written for publications such as

CEO Magazine, Business News Daily and the like. We will read and discuss each article. The class will then be divided into two groups, each favoring one or

the other valuation method. Each group will discuss why they chose the particular method. Summary statements will be recorded on the white board

listing the salient points about each method. At the end of the discussion the students will be asked to prepare a short Cost of Goods Sold calculation.

A list will be displayed of the inventory valuation method used by various major firms. The class will then be given a list of other companies and will be asked

to recommend the valuation method that each company should use.

BLOOM QUESTION (EVALUATING). Why is one valuation more appropriate than the other for a particular company?

Course Student Learning Outcome

1 - Prepare financial statements including an income statement.

Learning Objectives: By the end of this lesson, students will be able to

1 Explain the effects of inventory valuation on net income. (COMPREHENSION)

2 Choose the appropriate inventory valuation method for a given company. (EVALUATION)

Pre-Assessment:

Students will be asked to write the formula for determining Cost of Goods Sold (part of the income statement which is impacted by the inventory valuation method).

5 minutes.

Participatory Learning:

Time Instructor Activities Learner Activities Lesson Materials

25 min Discussion of inventory valuation and cost of goods sold. Answer question about how different businesses might Slide show explaining definitions

Introduce slide show. choose the valuation method they employ. of each valuation calculation.

Visit select website articles about inventory valuation. Website information displayed

BLOOM QUESTION (UNDERSTANDING). What effects of on classroom screen.

each method were presented in the articles?

30 min Record the summary statements for each group's Discuss pros sand cons of each valuation method Empty white board Chart

discussion on the white board. chosen for each business.

Provide a list of various business types and the BLOOM QUESTION (ANALYSIS). What are the pros and Continuation of slide show.

valuation method they use. cons of each method?

10 min Provide problems to be solved in Excel that require Solve problems in Excel. Problem information and

calculation of cost of goods sold using each valuation BLOOMS QUESTION (APPLYING) Did students gain formatted blank spreadsheets

method showing resulting effects on net income. sufficient knowledge to solve the EXCEL problem?

30 min Open forum about type of companies who should Discuss reasons for use of a particular valuation List of companies. End of slide show.

use each specific valuation system. method for the companies on the list.

BLOOM QUESTION (EVALUATING) Why should a

company use one method over the other?

15 min Ask for feedback about what was learned. Provide feedback about what was learned. None

Post Assessment: Review Cost of Goods Sold calculations to determine accuracy of students' recognition of applicable income statement effect.

5 minutes

SUMMARY: Adress any common missed questions discovered in post assessment.

CAT: Have students create inventory valuation questions for upcoming test.

15 minutes 5