Page 328 - Manual Of SOP

P. 328

Determination of Net Export Price

practice of the Authority, to compare the export price and normal value at ex-

factory level.

OPERATING PRACTICES

12.4. The Act and the Rules on Trade Remedy Measures have not defined the

term “exporter”. In the context of investigations, it is generally understood to be

the producer whose goods have finally been exported to India.

12.5. “Export Price” is the price at which the subject goods under investigation,

are sold or agreed to be sold, for export to India. EP is generally based on the price

to the first unaffiliated purchaser in India. As the comparison of EP and NV/CNV has

to be done at the same level of trade, there is a requirement to calculate ex- factory

net export price (NEP). Therefore, appropriate adjustments are required to be made

in export price (CIF/FOB/FOR etc.) for determination of NEP.

Pre-Initiation:

12.6. An application seeking initiation of investigation should be accompanied

with complete information in the prescribed formats duly signed and certified. This

information forms the basis for computation of NEP for the purpose of initiation of

investigation.

12.7. As per application proforma prescribed for DI and Trade Notice No. 15/2018

dated 22.11.2018, each application seeking initiation of anti-dumping investigations

should inter-alia be accompanied with the following information/documents:

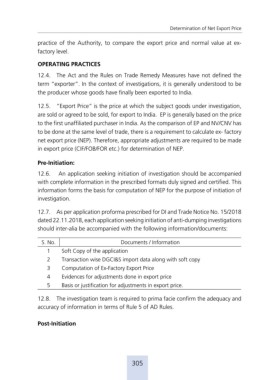

S. No. Documents / Information

1 Soft Copy of the application

2 Transaction wise DGCI&S import data along with soft copy

3 Computation of Ex-Factory Export Price

4 Evidences for adjustments done in export price

5 Basis or justification for adjustments in export price.

12.8. The investigation team is required to prima facie confirm the adequacy and

accuracy of information in terms of Rule 5 of AD Rules.

Post-Initiation

305