Page 62 - Praetura EIS 2019 Information Memorandum

P. 62

Praetura will ensure all investments

made within the Fund are suitable

The same for EIS qualification

investment offers

62% better return To qualify under the EIS rules, a company must meet

with EIS tax reliefs various criteria, the main ones are as follows:

than without

Qualification & Benefits • is established in the UK;

• isn’t trading on a recognised stock exchange at the time

of the share issue and doesn’t plan to do so (also known

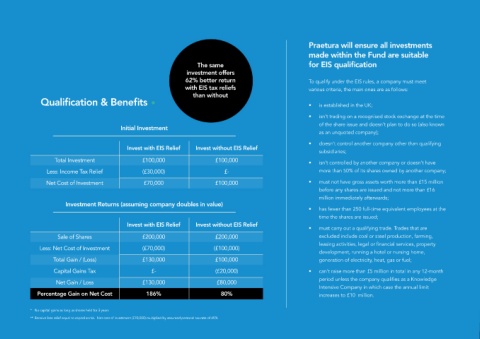

Initial Investment

as an unquoted company);

• doesn’t control another company other than qualifying

Invest with EIS Relief Invest without EIS Relief

subsidiaries;

Total Investment £100,000 £100,000 • isn’t controlled by another company or doesn’t have

Less: Income Tax Relief (£30,000) £- more than 50% of its shares owned by another company;

Net Cost of Investment £70,000 £100,000 • must not have gross assets worth more than £15 million

before any shares are issued and not more than £16

million immediately afterwards;

Investment Returns (assuming company doubles in value)

• has fewer than 250 full-time equivalent employees at the

time the shares are issued;

Invest with EIS Relief Invest without EIS Relief

• must carry out a qualifying trade. Trades that are

Sale of Shares £200,000 £200,000 excluded include coal or steel production, farming,

leasing activities, legal or financial services, property

Less: Net Cost of Investment (£70,000) (£100,000)

development, running a hotel or nursing home,

Total Gain / (Loss) £130,000 £100,000 generation of electricity, heat, gas or fuel;

Capital Gains Tax £- (£20,000) • can’t raise more than £5 million in total in any 12-month

period unless the company qualifies as a Knowledge

Net Gain / Loss £130,000 £80,000

Intensive Company in which case the annual limit

Percentage Gain on Net Cost 186% 80% increases to £10 million.

* No capital gains as long as shares held for 3 years

** Receive loss relief equal to capital at risk. Net cost of investment (£70,000) multiplied by assumed personal tax rate of 45%