Page 15 - Introduction to the Praetura Group

P. 15

15

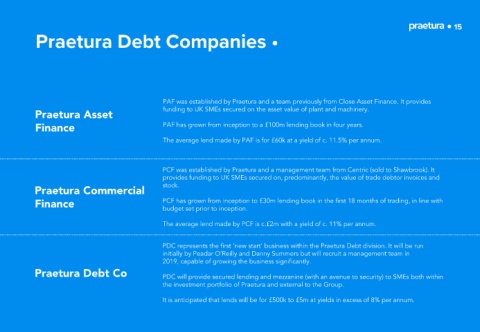

Praetura Debt Companies •

PAF was established by Praetura and a team previously from Close Asset Finance. It provides

Praetura Asset funding to UK SMEs secured on the asset value of plant and machinery.

Finance PAF has grown from inception to a £100m lending book in four years.

The average lend made by PAF is for £60k at a yield of c. 11.5% per annum.

PCF was established by Praetura and a management team from Centric (sold to Shawbrook). It

provides funding to UK SMEs secured on, predominantly, the value of trade debtor invoices and

Praetura Commercial stock.

Finance PCF has grown from inception to £30m lending book in the first 18 months of trading, in line with

budget set prior to inception.

The average lend made by PCF is c.£2m with a yield of c. 11% per annum.

PDC represents the first ‘new start’ business within the Praetura Debt division. It will be run

initially by Peadar O’Reilly and Danny Summers but will recruit a management team in

2019, capable of growing the business significantly.

Praetura Debt Co PDC will provide secured lending and mezzanine (with an avenue to security) to SMEs both within

the investment portfolio of Praetura and external to the Group.

It is anticipated that lends will be for £500k to £5m at yields in excess of 8% per annum.