Page 28 - Praetura EIS 2019 Fund Information Memorandum

P. 28

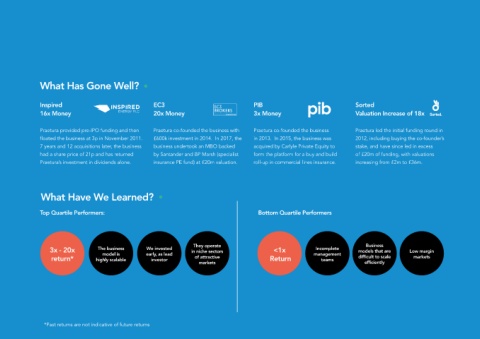

What Has Gone Well?

Inspired EC3 PIB Sorted

16x Money 20x Money 3x Money Valuation Increase of 18x

Praetura provided pre-IPO funding and then Praetura co-founded the business with Praetura co-founded the business Praetura led the initial funding round in

floated the business at 3p in November 2011. £600k investment in 2014. In 2017, the in 2013. In 2015, the business was 2012, including buying the co-founder’s

7 years and 12 acquisitions later, the business business undertook an MBO backed acquired by Carlyle Private Equity to stake, and have since led in excess

had a share price of 21p and has returned by Santander and BP Marsh (specialist form the platform for a buy and build of £20m of funding, with valuations

Praetura’s investment in dividends alone. insurance PE fund) at £20m valuation. roll-up in commercial lines insurance. increasing from £2m to £36m.

What Have We Learned?

Top Quartile Performers: Bottom Quartile Performers

They operate Business

3x - 20x The business We invested in niche sectors <1x Incomplete models that are Low margin

model is early, as lead management

return* highly scalable investor of attractive Return teams difficult to scale markets

markets efficiently

*Past returns are not indicative of future returns ** Assumed Sale Occurred in November 2018, in line with EIS Fund policies which state that Listed securities are to be distributed to investors after 7 years